The Brazilian government wants to expand the country’s railway network through the Amazon, aiming to cut logistics costs and increase the competitiveness of mineral and grain crop exports. However, this is likely to drive up deforestation and put pressure on indigenous and local populations, researchers have warned.

If all planned works are completed, they will add almost 50,000 km of railways to the national network, according to the Ministry of Infrastructure. This would represent a 165% increase in laid track compared to the existing 29,000 km network that has expanded slowly since the mid-19th century.

“Brazil has always invested little in railways and there has been no continuity,” said Hostilio Neto, professor of the transport engineering programme at the Federal University of Rio de Janeiro (UFRJ).

So far, most of Brazil’s national railways serve areas outside of the Amazon, but it could accommodate 4,000 km of new track awarded through concessions, and a further 9,600 km through authorisations. Anticipated private investment could hit 115 billion reais (US$23.3 billion) – all from Brazilian companies.

Amazon railways: cost reduction versus impacts

Jair Bolsonaro’s government argues that expanding the rail network will increase the competitiveness of Brazil’s commodities. The extension of the network could reduce domestic freight costs by a third, Marcelo Vieira, former secretary for land transport at the Ministry of Infrastructure, told Diálogo Chino. (Vieira was replaced shortly after this interview.)

“Trains are the best option to take large volumes of products with low added value [such as grains and minerals] from producing regions to consumption and export centres,” he said.

Types of partnership

A concession contract passes the operation of the public railway to the private sector. The company and the government share responsibility for the works.

Authorisation involves the company assuming more responsibilities in the works, such as requests for environmental licenses and the search for investors and rail operators.

The ministry claimed that using railways to transport cargo instead of roads would reduce CO2 emissions from that sector by two-thirds, without providing details. The expansion of the network, it says, would reduce road accidents, and boost regional economies and services, creating jobs. The modernisation of 10,000 km of track for passenger rail transit would also be integrated into the improved network, the ministry added.

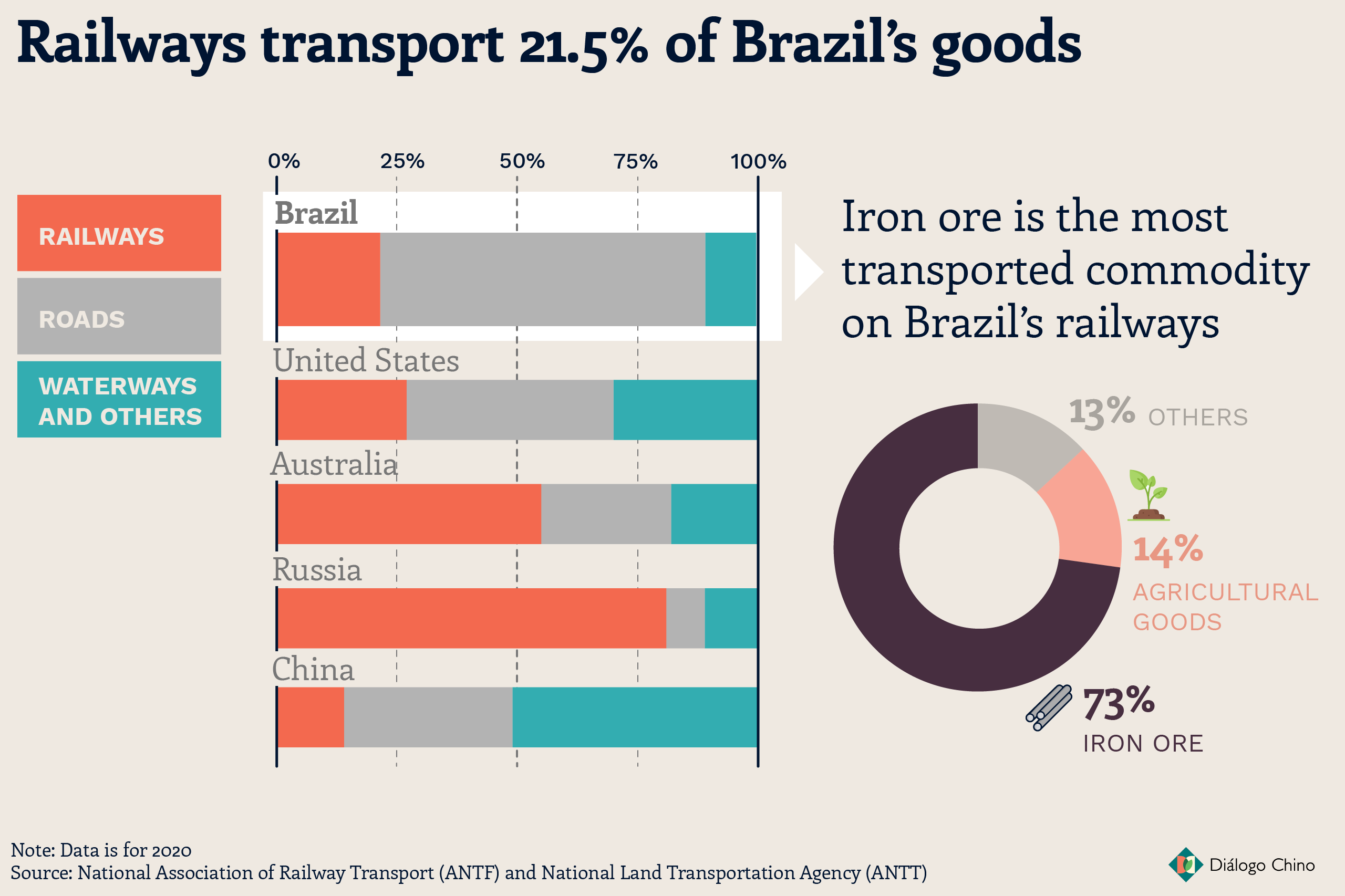

However, André Ferreira, director of the Institute of Energy and Environment (Iema), ciriticised the low level of product diversity on Brazil’s railroads. On average, 73% is iron ore, and the remainder is agricultural and other products.

“Railways have to be a real option for cargo carried by trucks today, but the lines currently cutting through and projected for the Amazon serve mostly agribusiness and mining,” he said.

Today, 67.7% of cargo in Brazil travels by road, compared to 21.5% by rail and 9.5% by waterways and cabotage (navigation between maritime ports), according to the country’s National Logistics Plan. Planned concessions and authorisations are expected to increase the volume transported by rail to 40% by 2035.

Neto, from UFRJ, added that the government is transferring almost all the responsibility for conducting the works to the private sector. Companies can “try to circumvent social or environmental interests in the projects. Some requests [for authorisations] are from micro-companies and may only be reservations for future negotiations,” he said, referring to companies’ practice of registering and reserving a stake in a project for future sale or participation.

Arco Norte takes commodities to international markets

Investment in infrastructure should boost commodity exports through Brazil’s so-called Arco Norte, a corridor of roads, ports and railways that traverses the Amazon and Cerrado regions, connecting major transit hubs and exporting goods via north and northeastern ports, rather than those in the south. It is receiving growing attention from governments and investors, since it would cut the distances and costs involved in reaching markets in Europe or China, and other destinations via the Panama Canal.

Today, the ports of the Arco Norte already export over 30% of Brazilian soy and corn and import similar amounts of fertilisers, according to the National Supply Company (Conab).

The Arco Norte would also facilitate access to the mineral, oil and natural gas reserves discovered in 2021 in Guyana and Suriname. Gas reserves in these countries exceed a combined 283 billion cubic metres – equivalent to the entire reserves of Peru, which generates 40% of its energy from natural gas. As a result, Petrobras, ExxonMobil and Chevron are among the companies eyeing investment.

A concession for 1,537 km of the North-South railway that connects the states of São Paulo and Pará, and the renewal of the contract for 892 km of the Carajás railway between Pará and Maranhão are already assured for the Arco Norte. Some 11 billion reais (US$2.2 billion) in private investment from mining company Vale and railway operator Rumo Logística, among others, is expected.

Still up for grabs is the 888-km Midwest Integration Railroad, known as Fico, between Mato Grosso and Goiás. A further 646 km of the same line, from Mato Grosso to Rondônia, are being studied.

Both networks will link to the North-South Railroad and connect ports in Maranhão, in the northeast, and São Paulo, in the south.

Ferrogrão generates conflicts

Ferrogrão (Grainrail) is a 993-km line connecting Mato Grosso to Pará. Its objective is to strengthen domestic trade and exports, and cut logistics costs and grains wasted in transportation via the BR-163 highway. The premise is to carry soy and corn out of Mato Grosso and export them to China, and to import fertilisers and oil derivatives.

Original plans were drawn up more than a decade ago but Ferrogrão has become a priority for Jair Bolsonaro’s government. The Federal Audit Court is analysing the project and demanding a prior consultation with indigenous peoples affected by it.

The Federal Supreme Court, Brazil’s highest judicial authority, is also looking into Ferrogrão. A March injunction issued by Minister Alexandre de Moraes paralysed the railway concession until the verdict of a case filed by the Socialism and Liberty Party (PSOL) against the reduction of Pará’s Jamanxim National Park, through which the network would pass. That reduction was confirmed by a legally enforceable provisional measure issued by former President Michel Temer in 2016. Currently, there is no date for the trial.

Nor would access roads and loading and unloading terminals be able to support the estimated 52 million tonnes of goods per year that the railroad would transport, UFMG pointed out. “Studies for the operation of the railway do not consider this, nor the cumulative socio-environmental impacts of railway expansion in the Amazon,” said Leles.

Brazilians want to know what the vision for the future is and what priorities the candidates have for the country’s infrastructure

Ferreira, from Iema, also questioned the need for works such as Ferrogrão, since the existing outflow through the southeast is more viable. The projects for the North-South railway and São Paulo state’s Malha Paulista network would distribute cargo through the southeast, where infrastructure is well established. This would reduce pressure on the north, where the Amazon and its people are located, he added.

The future of these projects could be determined by October’s presidential election: Jair Bolsonaro will seek re-election and has built on previous governments’ railway policies. Luiz Inácio Lula da Silva, the front-runner in the polls, has not yet articulated his plans for railways.

“Brazilians want to know what the vision for the future is and what priorities the candidates have for the country’s infrastructure. What we see so far are isolated projects, which add little in the long term,” said Leles.

Railways connecting to Peru

Since the 1970s, several railway projects between Peru and Brazil have been mooted. None have progressed.

The most controversial was the Brazil-Peru Transcontinental Railway (Fetab), launched in 2014 to connect Acre, in northern Brazil, to the port of Bayovar, on the coast of Peru. The project would cut through what is now the Serra do Divisor National Park, impacting rich Amazon biodiversity.

“For this reason, added to the lack of clarity on who would finance the project and the [lack of] political will on the part of the Peruvian government, it came to nothing,” said Marc Dourojeanni, an engineer and renowned environmentalist.

Bi-Oceanic Railway

Launched in 2015, the 5,000-km mega-project would link Santos in southeastern Brazil, to the port of Ilo in Peru, crossing Bolivia.

In 2015, Chinese investors even expressed an interest in the project, but negotiations fizzled out, Dourojeanni said. According to China Railway Eryuan Engineering Co. Ltd (CREEC), however, the northern route ending at Bayovar was deemed the most viable, at least in terms of its topography, a 2016 presentation by the company to Brazil’s senate showed. It remains one of the few publicly available documents on the issue. Today, the construction of a highway cutting through the same region is still on the table.

Launched that same year, the Bi-Oceanic Railway would link Santos, in southeastern Brazil, crossing Bolivia and reaching the port of Ilo, in Peru. The 5,000-km route would shorten the distance of Brazilian routes to the Pacific Ocean and, from there, to Asian markets. It also stalled due to lack of investment. In 2020, the Peruvian government claimed a lack of interest on Brazil’s part. Bilateral discussions are ongoing.

Less memorable is the Iquitos-Yurimaguas Interoceanic Railway, which would connect these two important cities of the northern Peruvian Amazon, with 555 km of tracks. However, the Peruvian government ruled it out because it would pass through Pastaza Fan, a Ramsar wetland site of international importance and the largest in the Peruvian Amazon.

“These speeches or attempts to develop railways have not materialised because there is no clarity. We don’t have a connectivity policy,” said Manuel Glave, senior researcher at Grade, a Peruvian development think-tank.

China’s interest in railways runs up against local issues

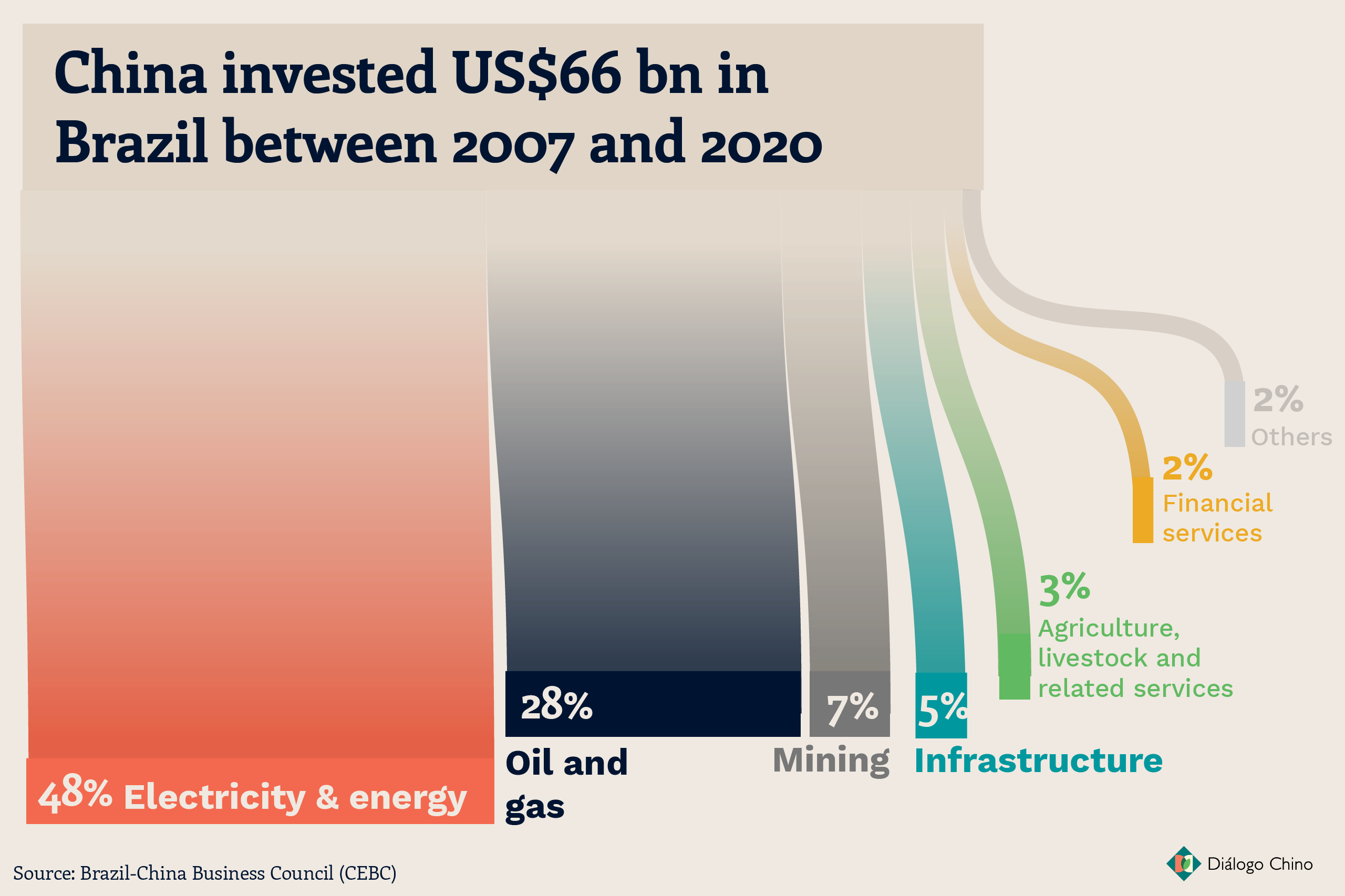

Brazil’s railways are of interest to Chinese investors, but their development depends on the country’s greater alignment with Brazil’s legal, political and environmental frameworks.

“Few countries have such favourable conditions for China for infrastructure projects as Brazil does,” said Tulio Cariello, Research Director of the Brazil-China Business Council, pointing to the availability of land and natural resources, as well as good political and bilateral trade relations.

“Brazil began to open up to internationalisation in the 2010s, at the same time that Chinese companies were seeking new global opportunities for investment,” he added.

In August 2021, China Communications Construction Company (CCCC) claimed financial problems led it to abandon the construction of a mega-port in São Luís, Maranhão. The project is associated with land grabbing and the forcible displacement of quilombola communities. It is unclear whether these factors also influenced the construction company’s decision.

With further information unavailable, the construction of the South Port by CCCC and its partner China Railway Group has not progressed. An agreement signed in 2019 between the government of Pará and CCCC enabled feasibility studies for the implementation of a 492-km railway in the state. The project did not get off the ground with Chinese capital and is likely to be taken over by Brazilian mining giant Vale.

With investment not forthcoming, the only tangible Chinese involvement in Brazil’s railways so far is represented by Fiol’s rails, which are imported from China.

Jack Lo also contributed to this report.