Institutional lenders are significantly underperforming when it comes to sustainable development in Latin America, kick-starting the region’s economic recovery or safeguard against climate change and the environmental impacts of their projects, according to a report released this week.

Less than US$ 15billion is spent on financing for climate change in Latin America annually, falling woefully short of the required estimate of US$ 110billion, new research by Boston University’s Global Economic Governance Initiative (GEGI) has revealed.

The research institute looked at finance provided between 2003 and 2014 for development and climate change from 11 institutions including the World Bank, the Inter-American Development Bank (IADB) and China Development Bank (CDB). It concluded that 33 percent is not “green” – meaning it is not allocated to tackling climate change mitigation and adaption, environmental protection or remediation.

China has played a crucial role in making up Latin America’s massive infrastructure spending shortfall, but as principal lender to the region, CDB has allocated just 6% of loans that total a staggering $US 82billion to “green” projects, the report found. At just 1% of its loan portfolio, only the Import-Export bank of the United States (USEXIM), which lent a comparatively paltry US$ 65 million over the same period, had a lower ratio of green finance.

Green finance from development banks is critical if countries are to meet the UN’s new Sustainable Development Goals. It also provides vital multiplier effects, sending positive signals on sustainability to the private sector, which currently provides over half the infrastructure spending in the region.

Priority partners

While USEXIM devotes most of its resources to the region’s more market-friendly economies like Mexico and Colombia, China lends to countries with “slightly higher risk profiles” such as Ecuador, Argentina, Bolivia, Brazil and Venezuela, report co-author Kevin Gallagher told Diálogo Chino.

“Chinese banks go to a different set of countries than the multilateral development banks (MDBs) because they finance a set of activities that, until recently, have not been as much of a priority, such as infrastructure and extractive industries,” Gallagher added.

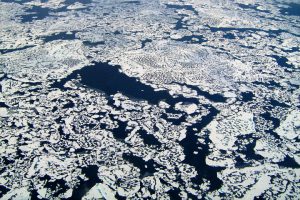

And China-backed megaprojects such as the US$ 4.7billion Kirchner and Cepernic dams in Argentina, and the Coca-codo Sinclair hydroelectric plant in Ecuador, financed by the China Exim Bank, are almost always situated in ecologically sensitive areas in Latin America. Chinese lenders disproportionately fund hydroelectric projects in the region, which simultaneously provide an export destination for construction materials and engineering know-how.

The research puts the total amount of green finance in Latin America since 2002 at 20% of the total from the development banks studied, whereas loans for conventional energy and infrastructure accounted for 14% and 18% respectively.

Although it may not seem like a big discrepancy, there are methodological problems in academic definitions of ‘green finance’ that could account for the difference. “It views hydro as ‘green’ from a climate perspective, but in Latin America’s tropical wet climates many hydro plants trigger a net increase in emissions due to methane and deforestation,” Gallagher acknowledged.

GEGI’s report comes as NGO Adaptation Watch lamented the lack of available information on financing climate change adaptation.

“Unlike measuring tons of carbon emissions avoided, adaptation is much harder to define and measure, and there has never been a global effort to define what should count as adaptation finance,” Adaptation Watch’s report reads. GEGI’s assures that it employed newly-revised research methods that aim to “close the gap” between tracking finance for mitigation and for adaptation.

In addition to insufficient finance from banks, recipient countries in Latin America are also falling short in their obligations to stimulate sustainable development and to adequately safeguard against the environmental risks of big infrastructure projects, the report adds.

Credit for China’s green policies

Fei Yuan, who co-authored the report with Gallagher, said that despite China’s emphasis on more risky countries and sectors, it deserved praise for imbuing its overseas lending with lessons from home.

“China is still a learner in both overseas investment and environmental standards, with the hope of it being a quick and creative learner,” said Yuan.

China also should be applauded for developing green credit guidelines for application overseas given its level of development, according to Yuan, who points out that China’s current GDP per capita level is only one third that of its Western counterparts when they started to establish safeguards to address environmental concerns.

China’s growing experience in dealing with domestic environmental issues and more collaboration with global partners through new platforms, such as AIIB, should yield more progress at the both the policy formulation and implementation levels.