The recent apocalyptic image of the ocean on fire in the Gulf of Mexico following a ruptured gas pipeline was reminiscent of The Lord of the Rings. Yet the world’s reliance on fossil fuels and their disastrous impact on global warming and the environment is far from fantasy.

The burning of coal, oil and gas is the dominant source of greenhouse gas emissions driving the increase in the global average temperature, which has already risen by around 1.1C above pre-industrial levels. The Intergovernmental Panel on Climate Change’s latest assessment states that it is unequivocal that human activities are responsible.

The International Energy Agency says that that to achieve the Paris Agreement goal of limiting heating to 1.5C, there can be no new oil and gas fields approved or new coal-fired power stations built anywhere. Yet, the UN’s Production Gap Report shows that countries are planning to increase fossil fuel production by 2% on average annually, which by 2030 would be more than double the production consistent with the 1.5C goal.

Latin American and Caribbean countries face hard choices. They can either continue to back fossil fuels or embark on an orderly and just energy transition in line with the Paris Agreement and a sustainable recovery from the pandemic. The latter offers an opportunity to create 1% of additional growth and 15 million new jobs in the region, according to the IDB macroeconomic outlook report for 2021.

Between a drill and a hard place

On the one hand, many countries depend on the demand for fossil fuels for fiscal revenue since close to half of what is produced in the region is exported. For example, from 2013 to 2018, on average 8% of public revenues in Ecuador, 6.6% in Trinidad and Tobago, and 5.4% in Mexico, depended on oil and natural gas exploitation, according to the OECD.

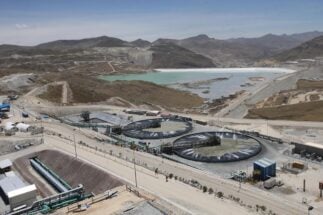

With the recent rise in oil prices and the pressing need to rescue economies, many countries in the region are looking to develop their fossil fuels. To date, considerably more funding has been allocated to them than renewable energy as part of recovery packages. While some national oil companies are improving their energy efficiency and reducing gas flaring, the region’s energy sector is not aligned with the Paris Agreement’s goals of reaching net-zero emissions by 2050.

The so-called just transition is crucial to ensure that climate-related policies do not exacerbate inequality and poverty

On the other hand, the growth in renewable energy and electric mobility poses challenges to fossil-fuel-dependent economies. Renewable energy is already cheaper than fossil fuels for most new uses and three-fourths of all new electricity generation capacity in the world comes from renewables. The increase in electric vehicle sales also shows the new direction of travel.

The IPCC’s Sixth Assessment Report states that for a 66% chance of limiting warming to 1.5C, the world has a remaining carbon budget of 360 gigatonnes of CO2, equivalent to nine years of current emissions. As pressure mounts to keep the 1.5C goal alive, countries may decide to follow the lead of countries such as Costa Rica and Chile, and accelerate their efforts to decarbonise, which could lead to a dramatic decline in fossil fuel demand.

This would result in fossil fuel reserves being left underground if the world sticks to a 1.5C goal-aligned carbon budget. These reserves would become stranded assets having been devalued or retired before the end of their expected useful life, which could lead to significant revenue loss for oil-exporting countries and those dependent on tax revenue from fossil fuel consumption, especially from transport.

A slow-motion blockbuster?

The concept of committed emissions is helpful to assess the impact of energy infrastructure on climate change over its expected lifespan, which can be around 30 to 40 years. Committed emissions are the emissions that will be generated by the operations of current fossil fuel power plants during that period.

150%

the increase in Latin America and the Caribbean's 'committed emissions' if all planned fossil fuel power plants were to be built

The committed emissions of current power plants in Latin America and the Caribbean are inconsistent with the Paris Agreement. If all the planned and announced fossil fuel power plants in the region were built, most of them based on natural gas, committed emissions would exceed the established limit by 150%.

The only way to reduce committed emissions is to close down existing power plants and replace them with renewable energy capacity, and to leave natural gas, oil and coal reserves underground. Doing so quickly, however, would require removing physical assets before the end of their planned lives, turning them into stranded assets and incurring significant costs to asset owners and workers.

Stranded assets can be caused by some government policies. The elimination of diesel subsidies imposes a new cost on taxis and bus companies, reducing their future revenues and therefore the current value of their business. Technological change can also lead to stranded assets: for example, if new renewable power plants undermine the competitiveness of old coal, diesel, or natural gas plants.

The abrupt devaluation of financial assets could create varying degrees of instability in financial markets, which in turn could lead to macroeconomic instabilities. Stranded assets could also create political instability due to a rapid loss of wealth among the owners of affected capital assets and affected workers. If the emissions reduction targets in the Paris Agreement are met, the global value of stranded assets associated with projects that have not yet recovered their initial investment is projected to be US$304 billion in 2035, US$180 billion of which correspond to the oil and gas industries.

An IDB paper shows that in scenarios consistent with the 1.5C goal, Latin American oil production needs to fall to less than 4 million barrels per day by 2035 – 60% less than levels before the pandemic. This would mean that 66% to 81% of proven, probable, and possible oil reserves will not be used before 2035. The fiscal impact would be enormous: regional oil exporters could lose up to around US$3 trillion in royalties by 2035 if strong global climate action materialises.

A just and orderly transition needs to start now

These estimates illustrate the importance for governments to design policies to identify and manage fiscal risks associated with the transition to net-zero emission economies.

Finance ministries can play a strategic role in managing these risks by designing a fiscal strategy to manage the uncertainty of possibly lower hydrocarbon revenues. They can also identify and manage the risks of stranded assets in infrastructure and industry. These ministries can also design policies that consider and address the distributional impacts on the economic sectors and affected workers and help the financial sector internalise climate risks in decision-making. The so-called just transition is therefore crucial, to ensure that climate-related policies do not exacerbate inequality and poverty.

In South Africa, efforts have been made to better manage the risks of stranded assets. The French Development Agency (AFD) and the South African Development Bank carried out an assessment, which looked at risks including a significant fall in fossil fuel prices and any investments that can increase exposure to asset stranding. The South African case suggests that governments can work to avoid or delay investments that could increase the country’s exposure to the risk of stranded assets and plan a progressive withdrawal from activities most exposed to the energy transition.

Sequencing also matters. The closure of fossil fuel production assets too quickly can increase the country’s energy bill, reduce the government’s ability to fund programs, and affect workers and communities. Conversely, a plan that is too slow – with big investments in additional infrastructure and overly optimistic assumptions for future hydrocarbon exports – would lead to a more abrupt transition with more bankruptcies, higher debt, and defaults when expected export demand is not met.

Looking ahead, a key task for policymakers, highlighted in the IDB strategy for the extractive sector, is to align countries’ mining and energy, climate, and fiscal objectives. Indeed, at present, the lack of a holistic approach impedes an orderly transition. As governments design long-term decarbonisation strategies and undertake investments to support the recovery from the pandemic, future oil demand and the prospects for domestic production will need to be carefully considered. To reduce the risk of asset stranding this decade and the likely fiscal and political consequences, a just and orderly transition must start today.

This article was originally published by the Inter-American Development Bank and is reproduced here with permission.