Since Pedro Castillo took office as president of Peru in July last year, he has insistently repeated that he will “massify”, or scale-up, production and consumption of gas for the benefit of all Peruvians.

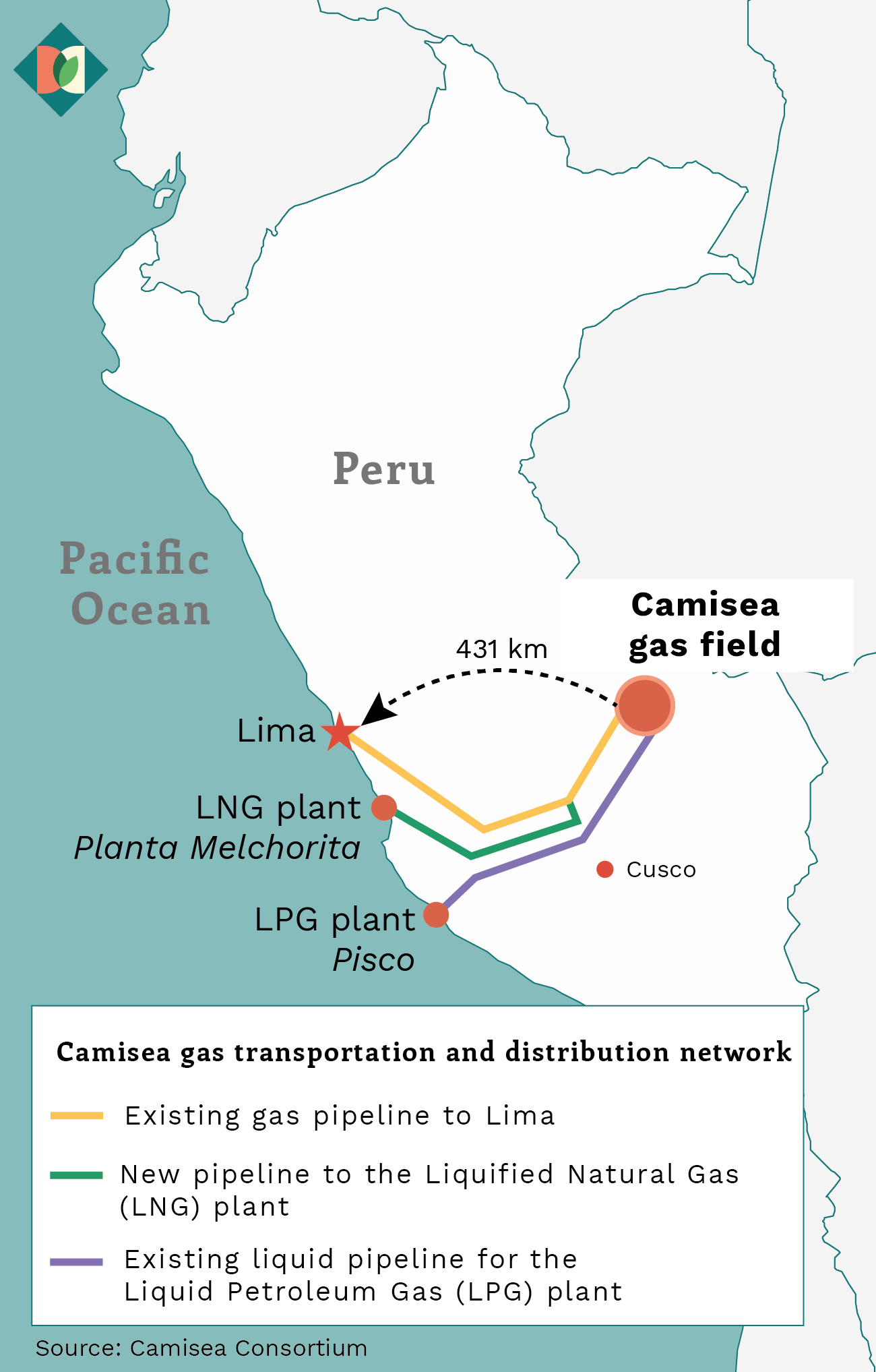

Gas currently provides more than 40% of the country’s energy, thanks to the discovery of the Camisea field in the department of Cusco, in the Peruvian Amazon. It is the largest of its kind in Peru, and represents 90% of national reserves.

However, while Castillo promises to continue exploiting gas, he also claims he will strengthen the foundations for Peru to become carbon neutral by 2050, repeating a pledge from his first message to the nation.

“Our government affirms its stated commitment to the United Nations Framework Convention on Climate Change,” he said, without elaborating on supporting actions.

So how can he reconcile the dual promises of carbon neutrality and gas for all Peruvians?

Competing interests: gas and renewables in Peru

Brendan Oviedo, president of the Peruvian Society for Renewable Energy (SPR), told Diálogo Chino that the government is interested in encouraging solar and wind energy, but warns that the continuous changes of ministerial officials “generate delays and impede the process.”

In his first nine months of government, Castillo has already faced a political crisis, surviving two impeachment attempts. He has re-shuffled his cabinet four times and the ministers of energy and mines on as many occasions.

“The political declarations have already been made. They just need to be channelled and regulatory changes made that will send out signals to investors,” he said.

Such regulatory changes, however, are not being ordered as quickly in the case of renewables as they are in the case of gas. So far, the current administration has not launched any strategy to encourage renewables, but it has put forward two major approaches to bring fossil fuels into Peruvian households.

36.9%

is the share of gas in the Peruvian electricity matrix, according to figures from the ministry of energy and mines. Only hydropower (55%) generates more

One is the bill on the Promotion of the Massification of Natural Gas (P.L. 679), which seeks to speed up the construction of gas pipelines through public investment and the implementation of a single tariff for gas at the national level.

The other is the report prepared by the Multisectoral Commission for the Massification of Natural Gas (January 2022), which proposes extending the concept of massification to the industrial and automotive sectors, in addition to the residential sector.

To this end, the commission has proposed relaunching the South Peruvian gas pipeline or SIT Gas, according to its Spanish acronym. The project has the capacity to transport up to 500 million cubic feet of gas per day but has been paralysed since 2016 due to financial problems with its corruption-plagued fomrer operator, Brazil’s Odebrecht, now known as Novonor.

To relaunch the pipeline, however, the commission believes that it is necessary to explore and tap new natural gas reserves.

Peru’s gas reserves and exploration

The latest official reference on the volume of natural gas available in Peru is the “Annual Book of Hydrocarbon Resources 2019“, published two years late in 2021 by the Ministry of Energy and Mines.

It specifies that as of 31 December 2019 proven natural gas reserves amounted to 10.14 trillion cubic feet (TCF). This is a fall of 37% in relation to those recorded in 2016.

Víctor Murillo, former vice-minister of hydrocarbons, told Diálogo Chino that the decline is explained by Peru’s inability to explore or exploit more gas.

“Today we have almost the same volume of natural gas discovered [at the beginning of the century]. About 0.5 TCF is consumed each year, but, in general, adding and subtracting, the gas we have should be enough for the next 25 years,” he says.

Humberto Campodónico, chief advisor to the multi-sectoral commission, estimates that to make SIT Gas viable, it needs 30 years of proven natural gas reserves, which implies adding an additional 5 TCF. This increases the urgency of negotiating with companies in the Camisea Consortium, which consists of Peruvian and international companies that controls two lots in the field, in order to meet delivery goals.

Also key to the overall effort is China National Petroleum Company’s (CNPC) Lot 58, which holds up to 3.47 TCF of natural gas, second only in Peru to Lot 88, controlled by Argentina’s PlusPetrol.

“For gas to be massified, it has to be brought to the markets (homes and industries). But how can it be transported? SIT Gas is one option, because we will have 25 to 30 years to exploit the gas we have,” Renato Lazo, an energy specialist and managing director of Energía ConTacto, told Diálogo Chino.

The global gas crisis

Experts see an opportunity for Peru in the global energy crisis that has afflicted Europe for some months now and which has been aggravated by the war in Ukraine.

Indeed, the shortage of natural gas in Europe as a result of the armed conflict – Russia supplies 45% of the gas consumed by European countries – has catapulted the price of the fuel to record levels and forced countries to look for other suppliers, including in countries as far away as Peru.

“The energy crisis has made Europe and China realise that an energy transition that is too fast will make electricity prices much more expensive. As bad as this may be, it is making us a bit more aware of the environmental goals that may or may not be achieved,” says Renato Lazo.

On March 3, the International Energy Agency (IEA) launched a 10-point plan to reduce Europe’s dependence on Russian gas. The plan includes maximising natural gas supplies from other sources, but also accelerating the deployment of solar, wind and nuclear energy.

For several specialists, this supports the argument that natural gas is a ‘stepping stone’ towards the energy transition, a position that the Peruvian Society of Renewable Energies shares.

“Natural gas plays an important role in the transition to a clean energy matrix, as it complements the progressive increase of renewable energies. By itself, it is not a transition resource, but it is the resource that will help make the energy transition viable,” says Brendan Oviedo.

Although renewable energies are much more competitive than natural gas today, they have a major drawback in that supply can be intermittent because, according to Murillo, a lack of sun or wind limits their efficiency.

“Intermittency has always been a problem limiting the growth of renewables, but the development of batteries capable of storing large amounts of energy is changing that,” according to Energy Exploration, a battery company. As this technology develops, Oviedo said, the role of natural gas is to serve as a cold reserve to support renewables in the power generation sector.

However, others have argued that natural gas has become more of a ‘wall’ to the energy transition than a bridge, given that with increased global emissions, time is running out and the opportunity to cross it has now passed. The potency of methane and the amount of fuel required to transport gas, in natural and liquefied form, along with emissions from leakages are cited as some of the reasons.With this position becoming more prominent in discussions about energy planning in the developed world, gas companies increasingly seek opportunities in developing countries with untapped reserves. However, this risks locking them into unsustainable energy policy choices in the long-term, critics argue.

Nor is natural gas immune from the new global financial dynamics, which are geared towards lending for renewable energy projects rather than hydrocarbons. The effect of this is that all new oil refineries and pipelines are beginning to experience interest rate increases and difficulties in securing credit.

“If we do not build the SIT Gas and other gas pipelines in the next five years, natural gas will have the same fate as rubber, because there will be fewer and fewer facilities to produce it,” warns Lazo, recalling the rubber boom at the beginning of the 20th century, which fizzled out when Southeast Asia began to produce more competitively than Peru.

State intervention as an option

“In two or three years we could have gas networks in Cusco, Ayacucho, Pucallpa and Huancayo, where the numbers do add up because the demand for gas exists. And so do the mechanisms”, says Victor Murillo, who suggests following the examples of Colombia and Bolivia, where the state intervenes directly, instead of leaving it to private companies, as has been the case in Peru.

The mechanisms mentioned by Murillo are the Energy Social Inclusion Fund (Fise), used to subsidise household gas connections, and the Hydrocarbon Energy Security System (Sise).

The idea, he argues, would be to entrust the construction of such grids to state electricity companies, “with a small reform in their structure” so that they can build quickly using public funds through Fise and Sise.

Such a move would need to be complemented by the construction of inter-regional gas pipelines, such as the SIT Gas and a possible line to the north, connecting the TGP (Camisea-Lima) pipeline with the one currently under construction by Promigas in Piura.

The latter is, however, easier said than done. The Multisectoral Commission for the Massification of Natural Gas recognised this and subsequently urged the government to declare the SIT Gas to be of national interest.

The natural gas massification policy is part of the government’s goal for Camisea’s gas to serve Peruvians and strengthen national companies. State-run PetroPerú could manage the gas pipeline networks.

Murillo’s proposal is contained in detail in the Multisectoral Commission’s 270-page report sent to the executive in January. The document concerns oil and energy unions because none were consulted on it.

Brendan Oviedo, president of the SPR, points out that the document urgently needs to be reviewed in detail, as only three pages refer to the renewable energy sector.

“This is why an evaluation by all the sectors directly and indirectly involved is necessary, a prudent period of time was indispensable in order to carry out this analysis,” he says.

The deadline for consultation expired on 28 January. To date, however, the Peruvian government has shown no signs of either approving or rejecting the document, preoccupied as it is with the country’s political crisis.