Beneath the plains of northwest Argentina lie some of the most abundant lithium reserves on Earth; from above, this sun-drenched corner of the country is among the regions with the highest solar power potential in the world. For the country’s lithium producers, this might just be a winning combination.

At several sites in the lithium-rich provinces of Salta and Jujuy, mining companies are exploring the use of solar panels to generate their own energy – a novel approach that would give companies independence from the national gas infrastructure and electricity grid, and contribute to increasing Argentina’s renewable energy production.

In a 2020 report on global solar photovoltaic power potential, the World Bank describes Argentina as having “excellent conditions”. Raúl Righini, of the University of Luján’s solar radiation study group (GERSolar), explains that the northwest “has very high levels of solar radiation throughout the year, comparable to the best places in the world.”

Also in producers’ favour are the costs involved in building and generating electricity using solar panels, which have been steadily decreasing. The International Energy Agency (IEA) estimates that, across the world, solar photovoltaic (PV) is among the cheapest forms of generation, in terms of per-kilowatt cost – in many regions, including the EU and India, it may already be the lowest-cost option, and by 2030 and 2050, the IEA’s projections put solar as the cheapest option the world over. These estimates also predate the spike in hydrocarbon prices seen since Russia’s invasion of Ukraine, and natural gas supply shortfalls, which have made solar even more competitive.

These developments come amid growing global demand for lithium in the energy transition, with high international prices and changes in Argentine legislation sparking a series of investments in lithium that could pave the way for the country to become the world’s leading producer in the coming years.

Solar projects

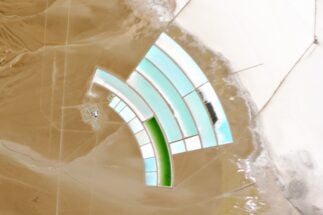

The lithium project in Argentina with the strongest commitment to renewables is Mariana, in the Salar de Llullaillaco desert of Salta province, which is being developed by Chinese company Ganfeng Lithium. Set to enter into operation at the end of 2023, Mariana will be home to a 120-megawatt solar plant for on-site generation, covering an area of approximately 100 hectares. It will be the largest solar plant in the country, outside of those connected to the national electricity system.

“It is an area where there is no connection to high-voltage electricity transmission lines,” Juan José Martinez, director general of the provincial Ministry of Mining and Energy of Salta, said of the Ganfeng project. “On the other hand, it is also impossible to use gas from the nearby Puna gas pipeline, because it is at capacity and cannot increase its delivery. So there is an energy isolation that justifies the initiatives of self-generation through renewables.”

A representative from PowerChina, the company chosen by Ganfeng to build the future solar park, told Diálogo Chino that the energy generated will be used to pump brine fluids during extraction, and to supply a chemical plant and the camp where some 300 staff will work. The panels will be complemented by a battery system, manufactured by Ganfeng itself in China.

Elsewhere, French company Eramet, which is building a plant to extract lithium ore from the Centenario-Ratones deposit, also in Salta, plans to start production in the first quarter of 2024. When fully operational, the plant would have an estimated consumption of 17 megawatt hours, of which 3–6 MWh would be supplied by solar energy. Not all of the energy the project requires can currently be met with solar due to the plant’s design, which uses natural gas-fired generators.

Daniel Chávez Díaz, executive director of Eramine, the group’s local subsidiary, told Diálogo Chino that solar energy can save money, “as the investment per megawatt installed is US$700,000, compared to US$1 million for conventional equipment. And once installed, the solar radiation is free.” Chávez did, however, point to the need for batteries for storage in addition to panels themselves as something that “raises costs a lot”.

Another venture looking to green its lithium production is Minera Exar, a company formed by Ganfeng, Canadian firm Lithium Americas and JEMSE, an Argentine state-run company, and which runs the Cauchari-Olaroz project in Jujuy. The project is expected to start lithium extraction and production this year, and has an agreement with state energy company YPF Luz to supply renewable energy to the site. The company told Diálogo Chino that it expects to meet 20% of its energy needs, equivalent to 4 MW of power, with renewable generation.

Other projects currently under construction do not plan to use renewables from the outset, such as South Korean company POSCO’s Sal de Oro lithium extraction plant, which will use diesel, and the Chinese mining group Zijin, which recently announced that it has begun construction of a lithium carbonate plant at the Tres Quebradas deposit, in Catamarca province.

So far, two projects in Argentina effectively produce lithium: the Salar de Olaroz (Jujuy), operated by the Australia-headquartered Allkem group in association with a subsidiary of Toyota and JEMSE; and Mina Fénix (Catamarca), run by the North American company Livent. Both have expansion plans underway and are supplied with electricity from the natural gas obtained through the Puna gas pipeline.

Lithium and renewable energies

The methods used for lithium production are in constant transformation. In addition, each salt flat has its own natural characteristics that make it necessary to adjust the approach. In general terms, the method that is so far most commonly used in Argentina consists of a first phase of drilling, to a depth of 200 to 400 metres depending on each salt flat, and pumping fluids to the surface.

The result is a brine with a very low lithium concentration, less than 1%. Through evaporation as the brine is exposed to solar energy, the lithium concentration increases over a period of 12 to 18 months. The solution is then transported to a chemical plant, where filtering processes and the application of solvents produce concentrates of up to 99% purity. The chemical phase is the most energy-intensive part of the production cycle.

“Lithium production and solar energy is a good combination, with radiation values in parts of Argentina being so high, even in the middle of winter there is plenty to generate energy. It is also true that solar energy requires an initially high capital investment,” explained Ernesto Calvo, former director of the Institute of Chemistry, Physics, Materials, Environment and Energy.

The lithium rush cannot be based on lowering costs at any price

For Leonardo Pflüger, national director for the Ministry of Productive Development’s sustainable mining production programme, solar energy can give a competitive advantage for lithium mining companies. “They have an incentive to decarbonise, but also Argentine law itself requires it, as it establishes that 20% of national energy consumption must come from renewables by 2025,” he said.

Mining companies such as Ganfeng label lithium produced from renewables as “clean lithium”. However, environmental organisations warn that there are also other variables at play that affect the sustainability of the activity, such as water use and waste management.

“There is a water balance between fresh water and brine that must be maintained, so that water for human and animal consumption – the key to life in the surrounding communities – is not affected. On the other hand, there must be proper management of effluents,” said Pía Marchegiani, director of environmental policy at the Environment and Natural Resources Foundation (FARN), an Argentine NGO.

“The lithium rush cannot be based on lowering costs at any price,” she adds.