“We’ve always had a dirt road, and if they put a little bit of asphalt on it to make it better, we’re happy,” says Teófilo Lemos, manager of the Pisisí Port in Urabá, a region in the western fringes of Antioquia department. Lemos is among those delighted at the prospect of the Mar 2, a new highway that is part of the government’s “fourth generation” infrastructure programme aiming to improve road connectivity throughout the country.

Colombia has an advantage over many of its South American neighbours: it has access to both the Pacific Ocean and the Caribbean Sea – a position that many feel has long been underutilised, and a missed opportunity for trade and development. For years, moving goods by land from the centre of the country to its ports, and vice versa, has been a nightmare: constant landslides, poor road conditions, and insecurity due to the long-running armed conflict have frequently brought delays and difficulties.

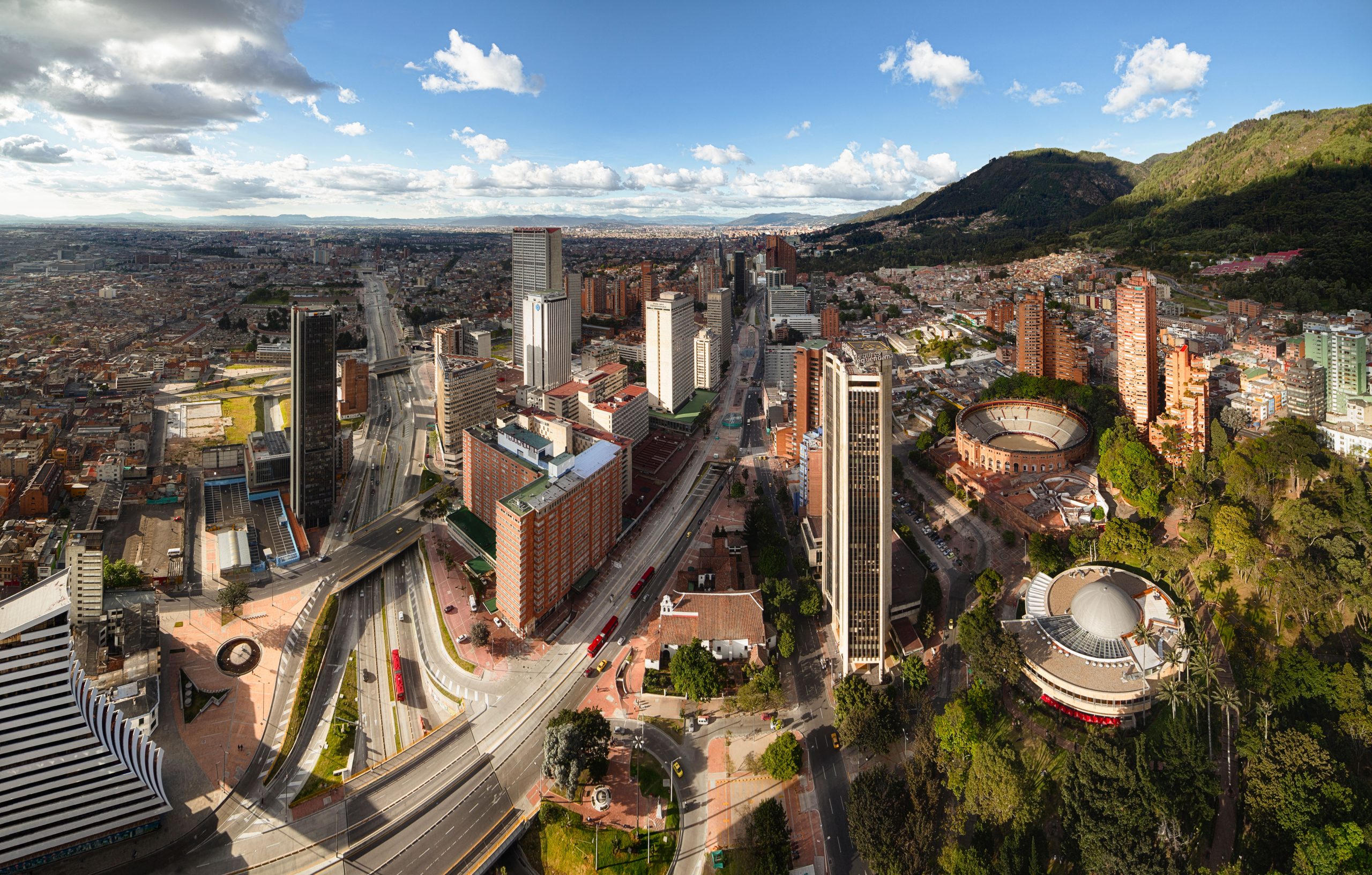

Colombia’s 4G roads

The South American nation has had long-running difficulties in upgrading its road network, but there are hopes for a smoother path ahead as its Fourth Generation of Road Concessions, launched in 2014, progresses. So far, three highways have been delivered, with Mar 2 the next due to be completed in mid-2022.

In 2014, Colombia was the least competitive of all the Pacific Alliance countries, according to the World Bank. It took an average of 14 days to export goods, while in Peru and Mexico, it was 12 days. At that time, Colombia had 900 km of dual carriageways connecting five ports, while Chile had 1,500 km connecting 32. In 2018, the detours that cargo trucks had to make due to poor quality roads cost the transport sector 5.6 trillion Colombian pesos (US$1.49 billion), according to a report by the Colombian Chamber of Infrastructure.

Looking to recoup these losses and bridge its infrastructure gap, the national government’s Fourth Generation of Road Concessions in Colombia (4G) programme has proposed a broad package of projects, grouped into clusters and corridors of roads in different areas of the country. These concessions began to be awarded in 2014, and together aim to combat Colombia’s low export competitiveness.

As part of the 4G programme, the target budget increase for roads will rise from 1% to 3% of GDP, in order to build more than 8,000 km of routes throughout Colombia. To date, three highways totalling almost 500 km have been delivered. By mid-2022, the next is set to be completed: the 254-kilometre Mar 2 highway that runs through Antioquia department, and which promises to bring relief to many, such as Teófilo Lemos.

Funding for the Mar 2 project has also come from abroad, via a public-private partnership (PPP) with Japanese and Chinese banks, in what was believed to be the first PPP infrastructure deal in Latin America involving a Chinese sponsor, when it was signed in 2015. The concession also saw the China Harbour Engineering Company (CHEC) awarded the contract to build the road, alongside five domestic construction companies, as part of the Autopistas Urabá consortium. PPPs with Chinese entities have become an increasingly prevalent format for infrastructure investment in Colombia, and one that and may offer an effective mechanism for Colombia to realise future projects proposed under the 4G programme.

As the highway approaches completion, hopes are high that it may herald change in a region – and a country – that has long struggled in its quest to improve its road network.

Mar 2: An important milestone

Mar 2 is part of a large set of 4G works that began in 2014 with the Pacifico 1, Pacifico 2 and Pacifico 3 highways, located in Antioquia’s coffee-growing regions. These seek to connect these areas with the southwestern Pacific and, specifically, with Buenaventura, Colombia’s largest port, which moves 60% of all goods entering and leaving the country. Linked to these are the Mar 1 and 2 highways, which aim to speed up the crossing of Antioquia from south to north, where they reach the region of Urabá. Here, on the Caribbean Sea, there are three ports – Puerto Pisisí, Puerto Antioquia and Darien International Port.

The Mar 2 highway connects the inland municipality of Cañas Gordas with Necoclí, on Antioquia’s Caribbean coast, with its 254-kilometre route divided into six segments. It aims to reduce the journey time from Medellín, the capital of the department, to Necoclí from eight to four hours. It is currently at 75% completion, across all its segments. According to Carlos Gaviria, vice-president of the National Infrastructure Agency (ANI), the road is on track to be delivered in mid-2022.

“We are pleased to support CHEC in a landmark transaction that can unlock future deals to continue this progress in meeting the region’s infrastructure needs,” Luis Maria Clouet, an associate at international law firm Clifford Chance, told LexLatin, an outlet focusing on the Latin American legal sector. The publication also cited statements from US firm Holland & Knight, which declared the project to be one of the first projects in Latin America to be financed via a public-private partnership (PPP) with a Chinese sponsor.

This PPP was carried out thanks to two lines of credit, with a value of US$652 million. The first was granted in tandem by China Development Bank, which contributed US$418 million, and the Japanese Sumitomo Mitsui Banking Corporation, which provided the remaining US$84 million. The second stream of credit is for US$150 million, from Colombia’s state-owned Financiera de Desarrollo Nacional (FDN).

According to estimates published by the Autopistas Urabá concession, Mar 2 will generate more than 14 trillion pesos (US$3.7 billion) as a result of transactions during the construction phase, and the annual GDP growth rate of the department of Antioquia will increase from 4.5% to 6%.

Although the work on Mar 2 is currently progressing well and one segment is already in operation, the project has suffered delays since work began in 2018. The arrival of Covid-19 in Colombia in 2020 led to several periods of strict quarantine that slowed progress. Gaviria, of the National Infrastructure Agency, explained to Diálogo Chino that, to mitigate the delay, the teams overseeing each segment were granted 96 additional days for construction.

Furthermore, this part of the country sees the meeting of mountains with jungle areas with high rainfall, which also brought about conditions that caused the works to be halted, to avoid the risk of landslides during the rainy season. Finally, the wave of protests that the nation saw between April and June 2021 also caused road closures, problems in importing supplies and acts of public disorder, such as the burning of a toll booth on the road.

A long-awaited project

Infrastructure projects the size of Mar 2 have frequently encountered criticism for their poor planning and execution, for their environmental impacts they generate, or as the communities living in the region see their territory invaded.

In Colombia, some of the most notorious recent cases include: the collapse of the Chirajara bridge on the Bogotá-Villavicencio road; the years-long delay due to corruption issues in the Ruta del Sol road – a project whose concession was granted to a group of companies, including the corruption-plagued Brazilian firm Odebrecht; or the slow progress that delayed the delivery of the La Línea tunnel in the country’s west. However, Mar 2 so far seems to have a different outlook, with widespread support and anticipation ahead of the highway’s completion, and limited controversy encountered. It has also provided a boost to local employment, according to estimates by the Ministry of Transport, with the construction of the road reportedly creating almost 10,000 jobs since 2018.

Teófilo Lemos, the manager of the Pisisí Port, told Diálogo Chino he was happy with the new highway. “The works keep on going, and this road is a blessing,” he commented.

Mar 2 will not only improve road infrastructure, transport and logistics in Colombia: a better road also means more possibilities to strengthen tourism in the region. Hernán Holguín, secretary of government for the town of Uramita, also told Diálogo Chino of his satisfaction with the road, and its prospects for increasing development in his town: “Our municipality will now be two hours from Medellín [Antioquia’s capital], at the midpoint between the capital and Urabá. We are aligning our own work with that of these major works, so we are building a boardwalk to attract tourism, and warehouses for cocoa and lemon producers to store their products. We are also planning to build a service station where there will be hotels and restaurants.”

Holguín points to another important benefit of Mar 2 for Uramita – one of route’s new overpasses behind the town that will allow cargo trucks heading towards Urabá to bypass it, and avoid passing through its town centre as is currently the case.

However, further north in the nearby municipality of Dabeiba, known as the “gateway to Urabá”, residents are worried that the Mar 2 highway will isolate them, than rather connecting them to the region. The town’s mayor, Leyton Urrego, told Diálogo Chino that the road project has brought the construction of a six-metre wall that prevents residents from accessing a nearby tunnel, whose entrance is a few hundred metres from the town centre and which previously allowed them to conveniently reach the other side. “You now have to go more than three kilometres to get around [the tunnel], and then come back the same way – which means you have to travel more than six kilometres,” Urrego recounts.

Urrego proposes that there should be an entry point 200 metres from Dabeiba, to allow access to the route as before, rather than requiring the new three-kilometre detour. He has asked the China Harbour Engineering Company for a basic feasibility study to investigate this possibility, and hopes to be heard.

The current government expects to deliver at least four of the eight 4G highways under construction in the department of Antioquia alone before the end of its term in 2022; Mar 2 is one of them. For the people of Colombia, it may take some time to forget all the failed projects and road initiatives that came before – not to mention the time and money wasted – but there is a building sense of hope that, this time round, the projects will bring the improvements they promise.