Official bodies from Brazil and Peru have expressed concern about the scarce attention paid by Chinese engineers to the social and environmental impacts of the proposed interoceanic railway in viability studies for the project, documents show.

Brazil’s state-run rail operator Valec said construction of the line through the area bordering Peru represented an “enormous” task that would necessitate a new city in the heart of the Amazon. Valec published its findings earlier this year in response to initial feasibility studies carried out by China Railway Eryuan Engineering Group (CREEC) in a report that has received little media attention given the global interest in the project.

Valec also criticised CREEC’s specific choice of route through the Amazon region and Andes mountain range. Though it would encounter less challenging topography and incur lower financial costs, their preferred option would have significant repercussions for sensitive ecosystems. The route, one of three left on the table, would also bisect an indigenous reserve, the report says. During a public hearing in the Brazilian senate on June 29 this year, CREEC representatives stated that all responsibility for conducting studies on the environmental viability of the railway lies with Brazil and Peru.

In rare statements from the Peruvian government, the ministries of culture and the environment told local NGO DAR (Environmental Law and Natural Resources) that it was imperative native communities be consulted on the 5,000-kilometre logistics corridor prior to its construction.

Along with suspended Brazilian president Dilma Rousseff and former Peruvian president Ollanta Humala, Chinese premier Li Keqiang signed a memorandum of understanding (MoU) to proceed with the studies in May 2015. The Brazilian and Peruvian transport ministries and China’s National Development and Reform Commission first agreed to look into the project in 2014. Until now, little has been reported on the viability studies with the ministries in charge of the project providing scant official comment. Work on the US$10 billion project which would link the Atlantic and Pacific oceans is scheduled to begin next year and be completed by 2025, according to CREEC estimates.

The railway is touted as a way for Chinese companies to avoid the costs of importing millions of tonnes of grain, metals and minerals from South America through the Panama Canal.

Final routes

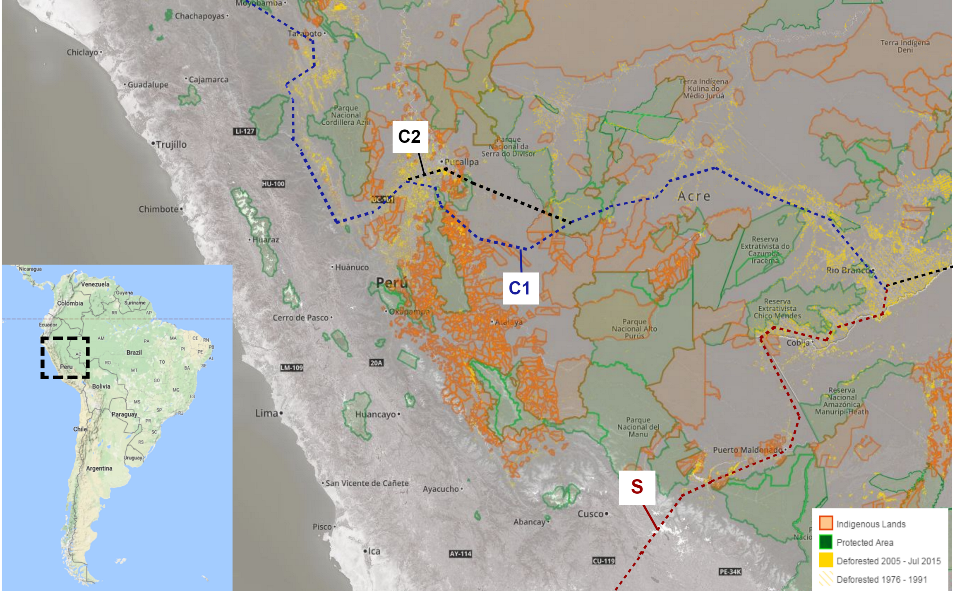

The most recent of CREEC’s three-part viability study (called the “interim report”), offers three possible routes, eliminating two from the five proposed in the first or “initial” report. Yet the two routes included in the first report appeared immediately non-viable since they would have crossed the Serra do Divisor National Park, which straddles the Brasil-Peru border area and is protected by laws in both countries. The final report is expected in the coming weeks.

The routes proposed in the interim report are the north (referred to in documents as C1), central (C2), and south (S). Of all the possibilities, CREEC’s preferred option is C1. Route S presents the least environmental impact and does not pass through indigenous territories or conservation areas. However, it is the least preferred by CREEC because it involves higher costs and complex geological challenges since construction would have to take place at altitudes up to 4400 metres.

“If this is the route, the railway will also cross rivers in their headwaters,” said Miguel Scarcello, secretary general of the NGO SOS Amazônia, said of route C1, adding that it bisects an indigenous reserve in Peru and several protected areas in the Amazon.

Work on the Brazilian stretch is set to begin in the city of Lucas do Rio Verde, in Mato Grosso state, the country’s agricultural heartland. From there, the line extends 3,300 kilometres to the border between Peru and the Brazilian state of Acre, and then another 1,700 kilometres to the Pacific coast.

However, according to Valec the border crossing would require a transfer station, since the gauge of railways differs in Brazil (1.6 metres) and Peru (1.4 metres). “Besides the need to establish a new city to house all the employees involved in the process, all this [takes place] in a very environmentally sensitive and sparsely populated region,” Valec concluded.

Peruvian concerns

Peru’s ministries of culture (MINCUL) and the environment (MINAM) also expressed concern about the impacts of the route known as C1. Specialist teams within the ministries declared that although the 1105-kilometre route was viable, it would likely affect indigenous communities living in its path, the documents obtained by DAR revealed. MINAM also noted that this proposed northern corridor crosses the protected Altomayo forest.

MINCUL said that C1 would avoid the risk of impacting Amazonian tribes living in voluntary isolation, but could still affect other native communities. As such, the ministry said, it would be necessary to hold a proper, prior consultation with those affected.

Researchers at DAR, a member of the Regional Group of finance and Infrastructure, told Diálogo Chino they feared the project would replicate the disregard for Amazonian communities shown during construction of the interoceanic highway.

Both ministries said that they had yet to see or be asked for their verdicts on the second (interim) report. Peru’s ministry of transport and communications, the department in charge of the project within Peruvian borders, did not respond to requests for comment from either DAR or Diálogo Chino.

Mountains to climb

“They say the geology can be an obstacle. But the geology is even more complex in China, which has made Chinese railway construction technology more refined,” Zheng Jianya, an engineer at CREEC, said in an interview with Diálogo Chino. “We understand that the potential geological obstacles will be overcome,” he added without referring to the environmental impacts of the project.

In Brazil, a 1,600-kilometre stretch of the project has been granted permission to proceed by environmental authorities. The Centre-West Integration Line (FICO), a Brazilian government proposal that has stalled since 2003, already has an environmental permit. Chinese contractors are now negotiating agreements with the states of Goiás, Mato Grosso and Rondônia, through which FICO would pass. Environmental impact studies for the line foresee the crossing of 96 perennial rivers.

But the new project must present a plan for constructing bridges, according to Larissa Amorim, transportation coordinator at the Brazilian Institute of the Environment and Natural Resources (IBAMA). Amorim also told Diálogo Chino the agency, which grants environmental permits, has not received any new licensing requests since the transcontinental railroad was announced. It takes at least a year for environmental licenses to be approved in Brazil, casting doubt on the proposed 2017 start date.

The Brazilian ministries of transportation and planning, which prioritised the project in a policy initiative called the Growth Acceleration Project (PAC), now refuse to comment on it. The process of impeaching Dilma Rousseff has radically changed the government’s public agenda, with ministries awaiting announcements from acting president Michel Temer on public spending. It is not certain that the railway will remain among investment priorities, although many influential senators defend the project in the capital Brasilia.

Finance

As yet the financing model for the construction of the transcontinental railway is unknown. Sources consulted by Diálogo Chino said Chinese investors intend to loan money to Brazil to build the railway. “What the Chinese are proposing is more or less this: I build the house and you pay for it, okay?” said Luiz Antônio Fayet, logistics consultant at the National Agriculture Confederation (CNA).

Another option could be a public-private partnership (PPP), which are increasingly common in Brazil. Supporters of the project say they believe in partnerships with local companies to encourage regional development. However, Fayet, who works closely with Brazilian agribusiness, said: “The private sector is completely sceptical with regard to the project.”

According to Fayet, the construction in 2014 of a new highway (route BR-163) in the Midwest of Brazil has rendered the interoceanic railway uncompetitive. Now, it is a more attractive option to transport primary products to the city of Miritituba in Pará state, then along the Tapajós River to the port of Santarém for shipping across the Pacific via the Panama Canal or around the Cape of Good Hope.

“What makes more sense is to move production out through the north, and the most economical mode of transport is the waterway,” said Rodrigo Koelle, South America transport director at logistics multinational Cargill. One of the world’s largest exporters of soybeans and corn, Cargill has extensive operations in Brazil, 80% of which goes to China. The company is currently developing two port terminals at Miritituba and Santarém. “The first studies I saw on the transcontinental railroad are far from improving on other logistics projects. The costs are very high,” Koelle added.

Larissa Wachholz, director of the Brazilian consultancy Vallya, which specialises in advising Chinese investors told Diálogo Chino the railway project is motivated by Brazil’s high logistics costs. “The Chinese initiative has to do with the view that the infrastructure of the exporting countries needs to be developed,” Wachholz said.

According to preliminary estimates, the transcontinental railroad would reduce the cost of exporting grain and minerals by US$ 30 per tonne compared to current routes. Once operational, the project could support a third of total exports from Brazil to China, some 35 million tonnes of soybeans annually.