Proposed by China in 2013 and commencing operations less than three years later, the Asian Infrastructure Investment Bank (AIIB) has quickly become a major intergovernmental institution. It has quickly attracted broad-based support, with 103 approved members worldwide, including three in Latin America.

The AIIB is the first international financial institution conceived of and led by China. It is the world’s fourth largest multilateral development bank (MDB) in terms of capital subscriptions, with US$100 billion committed by members. It is dedicated solely to financing infrastructure and infrastructure-related projects in member states.

The motivation behind the establishment of the AIIB is China’s discontent with the traditional, Washington-based MDBs and the way they function. It has questioned them for being too bureaucratic and slow in decision-making, and for failing to prioritise infrastructure. However, not everyone is convinced by that narrative, claiming the bank is a vehicle for the Chinese government’s overseas development goals.

Here, we explain more about the AIIB and why Latin American countries are starting to join.

Why did China create the AIIB?

Chinese President Xi Jinping first proposed an Asian infrastructure bank at the Asia-Pacific Economic Cooperation (APEC) summit in Bali in 2013. Xi said in his speech that the bank would be a new platform to coordinate economic development and help foster “a community of shared destiny for mankind”.

The AIIB is an expression of Xi’s long-term view of the need to improve the global governance system, which he says shouldn’t be monopolised by a single country. At the bank’s inauguration in 2016, he said the AIIB will make global economic governance “more just, equitable and effective”.

Bin Gui, a researcher at Beijing Foreign Studies University, said China also seeks to project its experience in infrastructure building in the international arena and to deepen domestic reforms by building a cooperative international order.

“The Bank aims to be a top-notch multilateral institution, and commits to the best practice and high standards that have been respected by the World Bank and other existing MDBs. China seeks to bind itself to an open and high-standards international institutional framework,” Bin wrote.

How does the AIIB work?

Headquartered in Beijing, the AIIB has now grown to 103 approved members worldwide (45 regional, 38 non-regional and 20 prospective). The US and Japan are the main absentees. Like other development banks, its mission is to improve social and economic outcomes in its region, principally Asia, but also beyond.

$50 billion

China's initial AIIB capital subscription (US$)

The AIIB’s initial total capital was US$100 billion, with 20% paid-in and 80% subject to payment on demand. China contributed US$50 billion. India is the second-largest shareholder, contributing US$8.4 billion. Recipients of financing may include member countries as well as international or regional agencies.

The bank has a governance structure similar to the other MDBs. It is headed by a board of governors, formed by one governor and one alternate governor appointed by each of the members. There’s also a non-resident board of directors, responsible for the direction and management of the Bank such as its strategy and annual plan and budget.

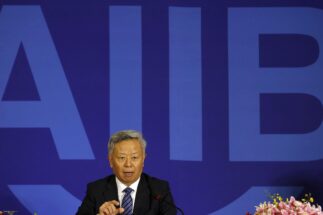

The bank’s president is elected by AIIB shareholders for one five-year term and is eligible for re-election once. The president is supported by senior management, which includes five vice presidents for policy and strategy, investment, finance, and the corporate secretariat. Mr. Jin Liqun is the current president.

How does Latin America fit with the Bank?

Brazil, Ecuador and Uruguay are the AIIB’s only confirmed member countries in Latin America. Ecuador was the first to join, in 2017, followed by Uruguay and Brazil in 2020. Each committed US$5 million to the bank. Argentina, Bolivia, Chile, Peru and Venezuela are yet to pay-up and be confirmed.

Latin America has chronically under-invested in infrastructure. Currently, only 3% of the region’s GDP is channeled towards vital transport and logistics projects, half the recommended 6% needed to sustain growth. Governments hope to at least partially address this gap by joining the AIIB and accessing its funding.

Ecuador received the first loan given to a Latin American country by the AIIB in December. It consisted of a US$50 million package co-financed with the World Bank to help small and medium-sized companies through the pandemic.

What’s the relationship between the AIIB and the Belt and Road Initiative?

Analysts say the AIIB’s discourse on its relationship between the Belt and Road Initiative (BRI), a central tenet of China’s foreign policy, has shifted over time. The BRI aims to boost economic and people-to-people exchanges between China and Central and South Asia, the Middle East, Europe and even Latin America, which Chinese diplomats have called “a natural extension” of the project.

In its early phase, senior AIIB officials stressed that while there might be some overlap between the AIIB and the BRI, since both are investing in infrastructure, but that the AIIB would not exclusively fund BRI projects. They stressed that the AIIB was not a Chinese, but a multilateral entity, based in China.

Jin said in 2017 that despite the fact that China is the host country and largest founding member of AIIB, the bank “is based on the experience of China, particularly massive investments in infrastructure that the country has built in recent decades”.

More recently, however, the tone has changed. Following the rapid growth in the number of countries joining, the AIIB now characterises its relationship with the BRI differently. In an interview with China Daily, Jin described AIIB and BRI as being two engines of an aircraft, both of which are needed for it to fly smoothly and high.

What consideration does the bank give to the environment?

The AIIB claims to put the sustainability of the projects it finances front and centre. The first article of its founding convention states that the purpose of the bank is to “promote sustainable economic development, create wealth and improve infrastructure” in Asia and beyond. It pledged to be “lean, clean and green”. That is, efficient in terms of its operations, ethical and transparent, and respectful of environmental and social impacts.

The AIIB does have an Environmental and Social Framework (ESF), approved in 2016 and amended in 2019. It covers a wide range of issues, from the need to protect the climate and biodiversity, to labour rights, public participation in resettlement operations and ensuring that indigenous peoples share the benefits of projects that affect them.

According to the ESF, the bank supports infrastructure and interconnectivity to promote economic growth and improve people’s lives, and it seeks to ensure that environmental sustainability is a key consideration in decision-making on the projects it finances.

Still, the environmental and social standards included in the ESF can be subordinate to the environmental and social risk management systems of the bank’s clients, whether they be in the public or private sectors. This is the case only when such systems are considered consistent with the AIIB’s ESF, or indeed stronger.

Do communities have a say in AIIB projects?

Project-affected people may raise concerns regarding the environmental and social impacts of an AIIB-financed project with the client and AIIB during the preparation and implementation of a project. To manage this, the AIIB created the Project-affected People’s Mechanism (PPM), which provides an opportunity for an independent and impartial review of submissions. It resembles similar mechanisms in other multilateral development banks.

Did you know…

The AIIB's board approved the Project-affected People's Mechanism to handle complaints by communities in 2018 after nearly two years of development and public consultations

The PPM has two main functions. First, to resolve disputes and facilitate dialogue between affected communities and the bank or the client. And second, to investigate whether the bank has failed to comply with its obligations in relation to the ESF, with social or environmental consequences.

In 2018, the AIIB also adopted its Policy on Public Information, which established what kind of information the bank should publish and when. Accessing information over a project cycle is essential for affected or potentially affected communities to get involved in an effective and informed way.

Overall, this policy is considered to meet minimum standards on an international level. The bank guarantees transparency by disclosing the information it has, although there are exceptions. The bank has to proactively publish the information of its own accord and can’t discriminate or give privileged access.

What criticisms are there of the AIIB’s operations?

Korinna Horta, an independent researcher, published a report last year on the AIIB in which she questioned the bank’s ESF as it is “open-ended and flexible”, has no track record of how it has been applied, and argued that the PPM asks for “burdensome” preconditions for affected communities.

Horta also claimed AIIB has a “corrosive” influence on other multilateral banks, which may weaken their requirements on public information and environmental standards in order to remain competitive. She called on AIIB’s shareholders to ensure the “robust supervision” of investments and to confront the bank’s leadership when necessary.

Jeffrey Wilson, a researcher at Murdoch University in Australia, said the AIIB has been frequently questioned for being dominated by China, with the Chinese government able to influence who borrows and on what terms. However, Wilson also said this has changed as the membership has expanded.