In Ecuador and Venezuela, two countries with ‘Bolivarian’ regimes, Chinese investment has found willing business partners in the past 10 years. China has injected huge financial resources into major infrastructure projects in both nations, many of which remain incomplete. The flipside of the coin involves strict conditions for Latin American partners including requirements to employ Chinese contractors.

Though signed in the 21st century, some contractual clauses seem to be from a bygone era: the suspension of labour rights; the import of Chinese workers; exclusive usage rights; high-cost finance; payment in foreign exchange; and other such 19th century privileges.

China’s aggressive expansion in Latin America has defined the region’s last decade. Ecuador and Venezuela have been two of the main destinations for financing, technology and Chinese labour.

The Sino-Venezuelan alliance was born with the creation of the Chinese Venezuelan Fund, through which the self-proclaimed government of the Bolivarian Revolution signed deals to upgrade the electricity network, among others.

In Ecuador, a close and wide-ranging relationship with China marked Rafael Correa’s decade in power. Seven out of ten works during his two terms in power were carried out by a Chinese company and were almost always tied to financing by a Chinese bank. Some of these projects, both in Ecuador and in Venezuela, failed to materialise.

An examination of the small print sheds some light on the conditions imposed by Chinese partners.

China’s formula for binding Venezuela

Venezuela is tied to China. In mid-September 2017, state-owned oil company Petróleos de Venezuela (PDVSA) published the price of Venezuelan oil for in yuan for the first time.

This was Caracas’ response to financial sanctions imposed by the Donald Trump administration aimed at preventing the Venezuelan government from issuing new debt. “We have decided to start a new phase of foreign trade with the use of internationally convertible currencies outside of the dollar,” Venezuelan President Nicolás Maduro warned in early September.

Giving the price of Venezuelan crude in yuan seems more than symbolic. It appears to be a consequence of the relationship Caracas and Beijing began to forge under the government of Maduro’s predecessor Hugo Chávez at the turn of the 21st century. Although initially conceived as the formula for the development of a “socialist” Venezuela, it resulted in the Caribbean country becoming dependent on China.

In 2008 the office of the Chinese Venezuelan Fund came into being, eventually resulting in a questionable US$50 billion financing scheme backed by Venezuelan oil, and conditional on the purchase of Chinese goods and the contracting of its companies for infrastructure works, housing or the electricity network. “This is a marvellous formula, financing for development. It is socialist development,” Chávez predicted in May of that year.

More than a decade later, having received three tranches of the bi-national fund, with hyperinflation and a fourth consecutive year of economic contraction looking likely, Chávez’s predictions for Venezuela seem wayward.

Only Odebrecht, the Brazilian construction giant disgraced by accusations of corruption throughout most of Latin America, can boast of more favourable agreements under Chavismo than those achieved by companies such as China Railway Engineering Corporation (CREC), China Camc Engineering (CAMC) or Citic Construction Company Ltd. (CITIC), among others.

The Ecuadorian formula for contracts with China

The relationship between the Ecuadorian State and several Chinese companies is deep and difficult to unravel.

The contracts that bind them are difficult to access. Finding out the precise amounts, conditions and institutions involved is a complex task. There is no state office or a single web portal that groups all the information together. Data is scattered among the various government entities that signed deals. Everything happens slowly and not all the information requested is forthcoming. Of thirteen requests for information for this investigation, only three received a positive response and the delivery of seven contracts.

To explain the motivation behind the labyrinthine process of acquiring contracts with Chinese companies would be to speculate. However, the likelihood is that at the root of such a lack of transparency lies corruption.

The lack of transparency also has a cost. A study carried out in 2011 FARO (Foundation for the Advance of Reforms and Opportunities) with the support of the Inter-American Development Bank Group —determined that, for example, the lack of transparency in the oil sector costs Ecuador at least 2.87% of gross domestic product (GDP) —more than two billion dollars.

Two billion dollars of public money would be sufficient, for example, to pay in full for the Coca Codo Sinclair hydroelectric plant. This is tax payers’ money. Obtaining access to contracts signed by the State should not be a task that only journalists are prepared to undertake. Along the tortuous route of trying to find information, we found that a common denominator in the seven contracts we were given was that they were agreed under a “special regime” (regimen especial), a method that often allows for more flexible parameters.

In five of those seven contracts, the work was tied to financing by Chinese banks. Both of these possibilities are foreseen in the Organic Law of Public Companies [Ley Orgánica de Empresas], approved in 2009. According Daniela Chacón, a councillor and former deputy mayor of Quito, this method of contracting is beneficial for politicians who “want to do things without transparency”. Chacón says that the fact that the contracts themselves determine the contracting processes (and how they will be regulated) creates a “supervision vacuum”. Transparency is lost under these conditions.

The small print of big business in Venezuela

On July 30 2009, China Railway Engineering Corporation (CREC), one of the firms belonging to China Railway Construction Corporation (CRCC), signed a contract with Venezuela’s State Railway Institute (IFE) for US$7.5 billion for the construction of the high-speed Tinaco-Anaco line from central to eastern Venezuela, part of the “northern plain transport hub”, under a “turnkey, closed lump sum category”.

Chávez himself authorised the hiring of CREC in “directive” no. 073-2009 dated 3 March 2009, based in turn on the agreement of economic and technical cooperation signed by both governments on 24 September 2008 in Beijing. “Obtaining credit with the world’s second economy, is a great endorsement for us. In addition, what is important is the purpose that these resources have given,” said Jorge Giordani, then Minister of Planning, in 2011. But the train today is an unfinished project.

his is in spite of disbursements worth many millions of dollars. The US$7.5 billion figure represents 70% of Venezuela’s international reserves and exceeds the cost of the recent expansion of the Panama Canal.

According to the contract, CREC should have finished it in “40 consecutive months from the signing of the commencement act”. Venezuela paid China Railway Engineering Corporation (CREC) 10.66% of the total in 2009, another 26.67% of the “total closed lump sum” in 2010, 30% in 2011 and finally the remaining 32.67% in 2012, as per their agreement. Although payments were subject to “appraisals for work executed”, the company made sure that the final price could be further increased during the course of “additional works”.

It was also assumed that the Venezuelan State would assume costs associated with the importation of machinery and equipment to carry out the work. Clause 95 of the contract reads: “The State Railway Institute (IFE) will be responsible for paying all expenses related to the temporary entry of equipment or the nationalisation of materials, spare parts and other items required for the execution of the work, as well as all expenses related to the importation and nationalisation of equipment, materials, spare parts and items intended for inclusion in the work”.

In the event of “delay in the introduction of imported goods and equipment into the country, for reasons not attributable to the CREC, and provided that the importation has been processed in due time, such delay will result in an automatic extension of the execution period corresponding to the same time as the delay”. This last provision is no small matter, if one takes into account that Venezuelan ports are among the most inefficient in the region.

In spite of the billion dollar amount and the magnitude of the work, the contract also established the possibility of the CREC subcontracting to companies without major restrictions. “The CREC should notify the IFE of the subcontractors it intends to hire and IFE reserves the right to reject such subcontracts when, in its opinion, there are reasonable grounds for such a decision, which shall be made within 11 consecutive days from receipt of the notification and receipt of the subcontractor’s documents”, clause 83 of the agreement specifies.

The clause allowed to China Railway Engineering Company to dabble in an economy experiencing double-digit inflation with various exchange rates

Thanks to this provision, the Chinese company, after charging the government in dollars, was able to contract Venezuelan construction companies in bolivars (the national currency), which ended up imposing more stringent than those IFE could set to CREC itself. “The price of this contract cannot be modified or adjusted”, state the contracts that the CREC signed with the Maquivial-Otassca Consortium and Basis CA, two of the companies subcontracted in 2010. This clause was not only a straitjacket for companies in struggling in an economy suffering from double-digit inflation, but also allowed CREC to dabble in an economy with several exchange rates, including the “parallel” market, where rates were well above official ones.

“Although the work was financed by the China Fund, these payments were made in national currency. How did they (the Chinese) sell the dollars? That was something that the Chinese did not divulge to the contractors,” explains a source familiar with the project, but preferring to remain anonymous.

In the case of the agreement with the Maquivial-Otassca Consortium it was agreed that; “lack of payment will not lead to work stoppages by the contractor”, while in the agreement with Basis, CREC established that “the contractor must work weekends, as well as on holidays”, a provision that conflicts with Venezuelan labour legislation. “To advance the weekend stretches, those Chinese who stayed on commandeered the machinery of the private companies”, the source adds.

The contract between China Railway Engineering Corporation (CREC) and the IFE also allowed for the possibility of hiring Chinese personnel. In principle, the company had to “make use of the human resources which were mostly Venezuelan nationals” (clause 21), but in cases of recruitment of Chinese personnel, it was agreed that “the IFE will cooperate and provide all necessary support to process and issue work visas, or any other document that would allow for the legal residence of such personnel in Venezuelan territory and for the time necessary for the execution of the work” (Clause 91).

This provision is duplicated in other contracts signed between Chinese companies and the Venezuelan State and, in some cases, has been the reason for complaints by unions toward the government. Questions about CREC’s parent company CRCC have also been raised in China. Sector regulator the National Railway Administration, sanctioned and fined CRCC in July this for “cutting corners”, carrying out modifications without consent, and committing other violations in its subsidiary’s railway projects (Chinese).

The financier of grandiose works in Ecuador

The link between China and Ecuador strengthened in 2009. The breakdown between Ecuador’s former president Rafael Correa’s government and US-based institutions agencies that had traditionally financed the country such as the World Bank and the International Monetary Fund forced him to seek money on the other side of the world. “China gets preferential treatment,” says Carolina Viola, a lecturer at the Pontificia Catholic University of Ecuador, who studies labour and environmental issues in Sino-Ecuadorian projects. “At a time when Ecuador received zero foreign financing, China covered their back,” she adds.

Chinese companies obtained 70% of public works contracts in the mining, oil and water sectors during the Correa goverment

At that juncture, the China became Ecuador’s main financier. According to Paulina Garzón, a specialist in Chinese investment in Latin America, Chinese companies obtained 70% of the largest public contracts in the mining, oil and water sectors during the Correa government.

Researcher Diana Castro established that there are 21 companies hired by public entities in 10 sectors for at least 63 projects: construction of hospitals, schools, bridges, buildings and roads. Castro says she also had difficulty accessing contracts between China and Ecuador.

Contracts usually tied to credits to pay for the works to be executed are, in general, 5% more expensive than those provided by the World Bank. The last decade was characterised by a hunger for grandiose works in Ecuador. The Government Financial Platform, a mega-building constructed to accommodate 2,800 civil servants working in economic ministries, is one of them. It was built by Chinese company CAMC, a subsidiary of the China National Machinery Industry Corporation (Sinomach), and the value of the contract has varied according to who reported on it, and when.

The project was criticised for the price being increased without any apparent justification. Urbanist John Dunn wrote: “For the first time in Quito, a building has been constructed that destroys the geographical condition of the valley where the city is located. You can no longer see Pichincha (the volcano) from Shyris Avenue or from Japan Street (in north central Quito). Perhaps we have confused ‘monumentality’ with ‘hypertrophy’”.

Days before its inauguration, after heavy rains, the gigantic works were flooded. In the car park many vehicles were half submerged in water. It is not the only project in the hands of a Chinese company that has experienced inconsistencies and setbacks. The Quijos hydroelectric plant was promoted as another of Rafael Correa’s emblematic works. Its construction was awarded to the Chinese company National Electric Engineering (CNEEC) for the sum of US$94 million and should have commenced in 2015. But it did not cost what was anticipated, nor was it delivered when it was supposed to be. The budget rose to US$110 million and its delivery was postponed until March 2016.

The latest information available from Ecuador’s Electricity Corporation (CELEC) from June 2015 says that the Quijos project was handed over at just over 45% completion. In December 2015, CELEC unilaterally terminated the contract with the Chinese company “for breaches of technical standards, quality and engineering in the execution of the work,” according Manuel Andrade, CELEC’s head of the project. He also explained that they were in the process of collecting US$25 million dollars for the contract performance guarantees.

CELEC did not respond to a request to confirm if the payment had been collected. The same company had been deemed a contractor in default for the Mazar-Dudas hydroelectric project in the south of the country on the fringes of the Ecuadorean Aamzon, one of the eight hydroelectric plants touted as pillars of the self-proclaimed Citizens’ Revolution, the ten-year process led by President Rafael Correa.

Coca Codo Sinclair was also another emblematic work and one in trouble. According to the Ministry of Energy, as of April 2017, the project was terminated at 95% completion. When it was tendered in 2008, the international call was conditional. It was open but it was tied to financing. The only two bidders were Chinese companies. State-owned Sinohydro Corporation was awarded the project for US$1,9 billion, around US$400 million more than the cost envisaged in the 2006-2015 Electrification Plan.

he difference between what was planned and what it ended up costing would have paid for 80 of the “millennium schools” that the Rafael Correa government built up to the time he left office in 2017.

Coca Codo Sinclair was fraught with technical questions and accusations of irregularities. In the book, Ecuador made in China, political activist Fernando Villavicencio sets out three problems with Coca Codo: they had no technical studies to justify the power (the amount of energy that could be generated) from the hydroelectric plant. Nor did they have any definitive studies for hiring when the tender was launched.

The Comptroller, responsible for the supervision of the use of the State’s property and money determined that between March 2010 and February 2012, none of the fines imposed on Sinohydro for non-compliance were applied.

The expected amounts were US$425,000 per day, but according to the watchdog agency, only phases I and II of the project were sanctioned, omitting all non-compliance with the audit or delays in the integration of personnel and equipment. “During project development, they did not comply with the monitoring and supervision orders with respect to delivery planning; they deferred the commencement of work on several fronts; they delayed the termination of several contractual benchmarks, breaches for which there are no penalties in the contract”.

The execution of the contract was set to begin when Eximbank handed over the funds for the work. However, it was eight months before the Chinese bank disbursed US$1,7 billion to the Ecuadorian State, or 85% of the project’s total cost. The works began more than two years later, on 28 July 2010. On radio and television in September 2014, then President, Rafael Correa complained about the delays: “This has to be finished in February 2016. They tried to convince me that no more than four short months were needed, as the tunnelling machine was jammed. We will not accept that as the contract is very clear”, he said, reiterating that he had ordered measures be taken to penalise the contractor if hand-over did not take place on the agreed date.

“Every day of delay is more than a million dollars that the country loses”, Correa stated. But these were mere words.

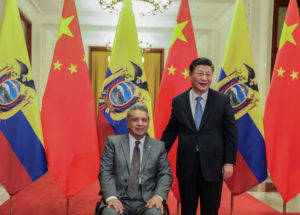

The inauguration took place nine months after the sheduled date, on 18 November 2016, in the presence of Chinese President Xi Jinping.

The growing Chinese presence in Ecuadorean infrastructure is born out of an interest in aquiring raw materials wealth. But it is not the only factor.

According to Yang Yong, a hydropower expert at the Hengduan Mountain Research Institute, there is also a major political factor: “China is seeking greater communication, and especially greater economic cooperation with South American nations. Ecuador is one of the countries that early on established diplomatic relations with China, which is why China prefers Ecuador”.

In this highly politicised scenario, hydroelectric projects have not always worked out well. Chinese companies need to reflect and learn from this, if they want the overall situation to improve, Yang says.

Chinese accounts

Failure of certain projects has not stopped the Venezuelan government contracting Chinese companies.

Last July, CAMC Engineering, which in 2007 formed the Camce South American Company, was appointed by the Maduro Government to implement a nickel exploitation project. In February 2016, a memorandum of understanding was published explaining that that the company could also participate in the southeast of the territory in the Orinoco Mining Arc, the plan with which Venezuela seeks to counteract the fall in oil revenues.

These businesses add CAMC’s more than US$3 billion of interests in sectors such as electricity, agriculture and infrastructure acquired in the past deacde, despite the fact that the Comptroller General of the Republic warned of this company’s irregularities in the execution of its first contract in 2003.

The agreement was for the construction of the “Bolivarian Aqueduct of Falcón State”, in the northwest of Venezuela, considered at that time to be “one of the most important hydraulic projects in Venezuela” thanks to the loan agreement of 20 December 2002 between the Venezuelan Ministry of Finance and the Bank of China, and according to the 2007 management report prepared by the Office of the Comptroller General of the Republic.

The document is an inventory of CAMC’s irregularities and defaults. “There were deficiencies in planning and in its administrative processes resulting in the reduction of the scope of the work and additional costs for the project. This situation was reflected in a delay of 352 days in its completion, expenses whose description are not directly related to the project, nor for the purpose of contracting, payments higher than those established contractually; omissions of relevant aspects in the contractual clauses (lapses of work guarantees); the inclusion of confusing contractual clauses, among others”.

The Comptroller General of the Republic also recommended that “the Chinese company CAMC be required to replace 335 metres of pipeline” for not having complied with the agreed technical specifications, and demanded that the authorities “confirm that the costs of excavation, extraction and transport, are not related to valuations of the Ministry of Popular Power for the Environment”.

Conclusions similar to those of the Comptroller General of the Republic can be drawn from the contract signed in November 2005 between Citic Construction Company Ltd., a subsidiary of Citic Group, and the Venezuelan Ministry of Housing and Habitat.

In that first agreement between the two parties for the construction of twenty thousand homes for US$900 million, the Chinese company established conditions of confidentiality such as “the contractor will not be required to disclose to the employer, or any third party on behalf of the employer, any financial or business information, or any document related to the contractor, its subcontractors, suppliers, carriers, agents, appointed manufacturers, consultants and their personnel (of any nationality, including Chinese, Venezuelan or a third country)”.

Just as the China Railway Engineering Corporation (CREC) did for the construction of the Tinaco-Anaco railway, Citic included in the agreement the option of hiring Chinese personnel. A clause in the document stated that “the employer shall arrange for the contractor to be authorised to operate the expatriate staffing activity of the non-Venezuelan contractor in accordance with Chinese labour standards (such as, but not limited to, caps on daily working hours)”, and that in cases where “the employer does not obtain these exemptions, the contractor will be entitled to an extension of time”.

Exemptions from taxes, payment of the contract “exclusively in US dollars” and the option to “increase prices in each payment for inflation of material and labour” were other conditions imposed by Citic on the Venezuelan authorities in that first agreement of November 2005.

The Venezuelan government relaxed some of these conditions in a “contract addendum” signed almost a year later, in August 2006. However, Citic had managed to hold onto very favourable business on Venezuelan soil.

In the first modification, the contract was quoted in euros. “Each house had an average cost of eighty thousand euros,” says one builder. The contract with Citic was revised several times until in 2011 they made more changes to the initial agreement, and the price of the houses continued to rise.

It was in July when President Maduro delivered some houses built by Citic at Fort Tiuna, in Caracas, one of six sites in which the Chinese company was to add to housing stock. “I thank China, the Chinese companies, the Venezuelan workers and firms. Thank you for everything you have done on a sustained basis because our commander laid the foundations for this new Tiuna City in the parish of El Valle”, Maduro said that day.

On the CITIC website, a press release also mentioned the event. “During his speech (Nicolás Maduro) expressed his gratitude to CITIC Construction for their valuable contributions to Venezuela’s Great Housing Mission (GMVV)… He also read with enthusiasm the names of the main Chinese participants, one by one, and sincerely thanked the Chinese people for their contributions to the construction and development of Venezuela”.

Venezuelan scholars and economists are not so effusive. In 2016, Professor Giovanni Gómez Ysea, a professor at the University of Carabobo, asked the Finance Committee of the National Assembly and then Attorney General Luisa Ortega Díaz to review the financing scheme with China.

The agreements, he said, are “illegal and onerous with leonine clauses against the interests of the Republic that have caused and continue to cause irreversible damage to the heritage of the nation”.

Virtually none of these projects in the non-oil sector are visible or operating

For Alejandro Grisanti, economist and partner at consultancy firm Econalítica, the sin is in the terms in which the relationship between the two nations was conceived.

“I think the relationship with China has been extremely negative, from the basket of investment projects in the non-oil sector that China supposedly had to develop, virtually none of these investment projects are visible or operating”.

Although he considers the alliance between the country with the largest oil reserves in the world and the one with the greatest demand for energy a strategic one, Grisanti insists that the outcome for Venezuela is not favourable. “The balance as of today is negative; the balance is one that was granted under conditions of much inequality, with provisions for the importation of finished goods versus capital goods; it is important that Venezuela has more than a just a ‘one on one’ relationship with China and can set long-term strategic objectives”.

Cases like those of vehicle manufacturers Chery and Yutong, or appliance maker Haier – Chinese companies whose products have enjoyed a major market share in Venezuela with hardly any investment, confirm the words of the economist.

In Ecuador, it’s not only central government that has favoured Chinese companies.

China Road and Bridge Construction bought the well-known Hotel Quito from the Bank of the Ecuadorean Institute of Social Security (Biess) for US$30.8 million, some US$7 million less than auditor Price Waterhouse Cooper’s valuation.

In October 2017 under the government of new president Lenin Moreno, the General Comptroller of the State, which is responsible for supervising the use of public goods and funds in Ecuador, released its final report in which it focuses on the sale and aims to determine criminal or civil legal responsibility on the part of those in charge of it, including the director of Biess, Richard Espinosa.

Espinosa could end up being dismissed because of another report by the same state agency relating to supposed irregularities in the Biess’ management of national debt. CRBC is also the beneficiary of one of the most controversial road projects in Ecuador.

Encouraged by the municipality of Quito and opposition mayor Mauricio Rodas, the so-called “Guayasamín road solution” – a bridge aimed at solving the capital’s worsening transport congestion – has given rise to criticism from urbanists and citizens since its conception.

Not only would it cause a bottleneck of cars during rush hours and displace residents of the Bolaños neighbourhood, but it would contrive to make the city less accessible for pedestrians. Deputy mayor Daniela Chacón resigned over the project.

In April 2016, Rodas announced the construction of the project which, he said, would benefit 300,000 people who travel from the valleys surrounding Quito, and vice versa.

The cost of this “solution” was over US$130 million. CRBC were to administer the motorway for 30 years and would charge a toll, as outlined in the more than 500 page contract. However, the same feasibility studies carried out by CRBC state that the works would be efficient for just 5 years after their inauguration. After this, the quantity of cars that was projected to grow so much that the “solution” would be unviable.

The contract places constraints on the next eight mayors of Quito, with one clause saying that if the municipality builds alternative roadways between Quito and the Cumbayá valley (or if it creates any alternative that could reduce the number of people using their project), then CRBC could terminate the contract unilaterally and demand indemnity for the losses for the remainder of the contract.

According to Chacón, the technical reports that support the “Guayasmán road solution” are insufficient. “The Department of Mobility and Planning’s report has a page and a half that is in large part filled with background. The financial report doesn’t clearly explain why they awarded a 30-year concession, nor does it explain the value of the toll or why the Chinese company’s profits need to be 15%.”

For Chacón, it seems only the Chinese company could approve a financial formula stipulating these returns. As of August 2017, the project is suspended because of archaeological discoveries in the earth where the highway’s bases were to be built.

A year earlier, the municipality of Quito and CRBC agreed that they would carry out definitive studies and would resolve any failings in the original project that they discovered. However, today, studies have still not been published and are supposedly 70% completed. The work itself is no more than 3% complete.

******

Since the early 2000s, China’s state policy of ‘zhou chu qu‘ (going out) has encouraged large Chinese industrialists, such as hydro engineers Sinohydro and Gezhouba, to seek projects abroad. “These companies were ministries at one time, then they became state-owned companies and then companies where the government still has a majority holding”, says Darrin Magee, a hydropower expert at Hobart & William Smith Colleges.

According to Magee, these companies have international divisions and are implementing hydroelectric projects basically wherever ‘development’ is needed. It is especially true if the construction of dams, roads and other infrastructure facilitates China’s access to mineral, timber and agricultural resources.

With the ‘pink tide’ that brought leftist governments to power across Latin America since the turn of the century, countries like Ecuador and Venezuela turned away from their traditional sources of finance. China saw an opportunity to fulfil the promises of development of their populist leaders. Chávez (and Maduro) in Venezuela saw in Chinese banks and Chinese companies a resolution to stalling national progress. Rafael Correa in Ecuador soon followed.

But the results of the alliance with China, announced as a formula for Venezuelan development for more than a decade, are shadowy, with some projects failing to materialise. Similarly in Ecuador, the construction of mega-works by Chinese companies has experienced problems, delays and terminations for non-compliance – a trace of China’s footprint in Latin America. This report was produced collaboratively with Armando.info and GK.City. Mayela Armas and Ludovica Meacci contributed to the investigation.