In the 12 years since Peru and China signed a free trade agreement (FTA), the Latin American country has had six presidents. It has also had numerous social conflicts: in October this year alone, there were 198, of which 129 were classified as ‘socio-environmental’ by the Ombudsman’s Office. At the same time, trade between Peru and China has progressively increased, only experiencing a downturn in imports and exports in 2020, owing to the Covid-19 pandemic.

Roberto Sánchez, Peru’s Minister of Foreign Trade and Tourism, told Diálogo Chino that since the FTA entered into force in 2010, trade with China has more than doubled. “This growth has allowed Peru to diversify its export basket to this market, with more than 700 new products exported, 96% of which were from the non-traditional sector, such as metallic products, chemicals and textiles,” he said, adding that more than 1,500 new exporting companies are involved in the trade, 74% of which were ‘micro’ or small businesses.

“With these results, we can reaffirm that the FTA has allowed us to consolidate Peru’s presence in Asia,” Sánchez said.

Pedro Castillo, who became president at the end of July, has signalled his plan to maintain good relations with China. “China is a strategic partner for Peru in terms of trade and investment,” he said in October, during the inauguration of the Canton Fair, an international trade event in Guangdong, China.

In November, on the 50th anniversary of the establishment of diplomatic relations between the two nations, Castillo stressed that China “is our main trading partner” and that ties between the two countries have been strengthened “since we upgraded our relationship to a comprehensive strategic partnership”, a high diplomatic status that China confers on selected international partners.

In the short time since Castillo entered office, China’s ambassador to Peru, Liang Yu, has had more than ten face-to-face or virtual meetings with members of the cabinet, including the heads of the foreign ministry, Ministry of Economy and Finance, and of Foreign trade and tourism. He also met the president himself on 30 August.

Celebrating 50 years of diplomacy, the ambassador said that the two countries not only seek to ‘upgrade’ their FTA, but have also signed a memorandum of understanding under the framework of the Belt and Road Initiative. They also cooperate on Covid-19 vaccines: Peru has bought millions of vaccines from Sinopharm.

Yet, Castillo’s positive messages on trade ties with China clash with his somewhat contradictory messages on private and foreign investment in the country. He recently announced a second agrarian reform and called for the nationalisation of assets such as the Camisea gas plant in the southern Cusco region, creating considerable uncertainty.

Peru and China: a question of numbers?

The 2009 FTA between Peru and China – with its 17 chapters and 12 annexes – was the first comprehensive trade agreement that the Asian country signed with a developing country. It covers goods, services and investment.

In 2011, China displaced the US as the main destination for Peruvian exports. Almost a decade later, in December 2020, ambassador Liang Yu said that the FTA “has served as a locomotive for the development of economic and trade relations between China and Peru, and has helped bilateral trade make great leaps”.

Denisse Linares of Derecho, Ambiente y Recursos Naturales (DAR), a Peruvian NGO that has followed the renegotiation of the Peru–China FTA, said the relationship can be viewed positively: “We have opened the way to having an exchange with one of the strongest countries in terms of trade.” However, she adds that “this relationship has not been accompanied by productive diversification”, meaning a move away from a reliance on raw materials. “This may benefit China, but not us.”

Did you know…?

Copper accounts more than 60% of Peru's exports to China

In 2019, mining products represented well over 80% of total exports to China, and copper alone accounted for over 60%. 2020 boasted a similarly dominant profile for mining, despite pandemic disruption and restrictions on movement, since operations were granted special dispensation to continue.

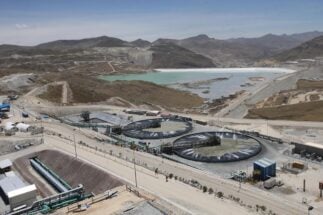

After the UK, companies headquartered in China are now the largest investors in Peru’s mining sector, with investments of more than US$15 billion, according to the Ministry of Energy and Mining. The list is long, but among the main projects are Las Bambas, in the department of Apurímac, and Toromocho in Junín. Both are copper mines. Peru is the world’s second largest producer.

Significant Chinese investments have also been made in the energy, electricity, fishing, finance and infrastructure sectors. Among the most notable projects are the mega-port of Chancay, to the north of the capital, Lima, which is being built by a consortium led by the Chinese state-owned Cosco Shipping Ports (with some US$3 billion in investment); gas exploration at Lot 58 in Cusco department by China National Petroleum Corporation (CNPC, US$4.4 billion); and the Amazon waterway, an initiative involving China’s Sinohydro, which is thought to have invested US$95 million. China’s Three Gorges Corporation (CTG) has also bought stakes in the Chaglla hydroelectric plant, and Luz del Sur, Peru’s largest electricity distribution company

Linares of DAR says that projects such as the Chancay port and the waterway have had problems with environmental impact studies. Likewise, social conflicts have flared at mining projects in the country, such as Las Bambas, where dialogues between communities and mining companies are ongoing.

Beyond traditional exports, the FTA has opened up a market for Peruvian agricultural products. “Obviously, around 95% of our shipments to China are minerals and fish. But excluding that from the analysis, the 5% we send to China that are non-traditional [goods] have been growing very steadily,” Rafael Zarich, manager of Economic Studies at Comex Peru, one of the country’s main business associations, told Diálogo Chino. “The FTA began in 2010, and in the case of agriculture it [the value of exports] has gone from US$30-35 million to almost $200 million.” Zarich points to the export market for blueberries and grapes as some that have been consolidated by the FTA.

This relationship has not been accompanied by productive diversification. This may benefit China, but not us

Beatriz Salazar, from the Peruvian Centre for Social Studies, told Diálogo Chino that the increase in agricultural products is positive, especially that of high value goods. However, she warned about ‘negative externalities’, among them the environmental impacts of this agricultural growth: “In terms of water, the aquifers on the coast are being overexploited, and in terms of biodiversity, large areas of the coast are being devoted to a single crop”.

“We must not only pay attention to the quantity of products exported, to their value, but also to their sustainability, to ensure that they do not have hidden negative externalities,” Salazar stressed.

Ana Romero, of the Peruvian Network for Globalisation with Equity, said: “There are no benefits for the populations where these investments are located. In agro-exports, you can see that the issue of water, and its exacerbated use, harms the surrounding areas.”

Does the FTA need an environmental chapter?

In November 2016, China and Peru agreed to “optimise” the FTA. Negotiations began in April 2019, and in October 2019, Lima hosted the fourth round of talks. Rules of origin, customs procedures and trade facilitation, global supply chains, intellectual property, investment, competition policy, trade in services and e-commerce were all on the agenda – but environment wasn’t. Then came the pandemic, and talks ground to a halt.

Trade minister Roberto Sánchez told Diálogo Chino that, in the current context, it has not been possible to hold a new physical meeting, but that both teams continue to coordinate virtually.

For Linares, Salazar and Romero, the agreement cannot omit an environmental chapter.

On the possibility of including a dedicated environmental section, Sánchez said that the agreement “already has a very complete chapter on cooperation between the two countries, which addresses mechanisms related to environmental issues”.

“The Peru–China FTA has led to the establishment of specific frameworks under which both countries can work together on environmental issues, and it is important to note that in 2016 an ‘Environmental Cooperation Agreement’ was signed between the Ministry of Environment and China’s Ministry of Foreign Affairs, aimed at promoting cooperation in the field of environmental protection and sustainable management of natural resources,” Sánchez added.

Mónica Núñez, a professor at the Universidad del Pacífico who specialises in environmental governance and the sustainability of Chinese investments in Latin America, said China and the international market are increasingly adopting sustainability standards applicable to different industries, which are voluntary, but as the market advances these guidelines are becoming the new standard. “Various Chinese sectors and guilds that invest abroad are increasingly adopting these guidelines,” she said.

Linares, however, believes parties must insist on an environmental chapter in the FTA because of the amount and nature of Chinese investments in Peru. China, she adds, has published a list of investments that it will not support if they do not meet environmental standards. “We are at a moment where we can take advantage of the fact that China is willing to do better.”